The recent news of Zillow’s plan to shut down their iBuyer program due to a $328 million loss in the third quarter has heads spinning in the real estate world and on Wall Street. Sadly, Zillow plans to eliminate 25% of its workforce because of its decision to move away from the practice of purchasing and re-selling homes due to their mismanagement of property price evaluations. “Fundamentally, we have been unable to predict the future pricing of homes to a level of accuracy that makes this a safe business to be in,” Zillow CEO Rich Barton.

This is a bold statement from a CEO who built their company on a computer algorithm that spits out a home value called, the Zestimate. A Zestimate is an AVM (Automated Valuation Model). The product of an automated valuation technology comes from analysis of public record data and computer decision logic combined to provide a calculated estimate of a probable selling price of a residential property. An AVM generally uses a combination of two types of evaluation, a hedonic model and a repeat sales index. The results of each are weighted, analyzed, and then reported as a final estimate of value based on a requested date.

Zillow’s iBuyer program sought to find eager home sellers who wanted a quick, no-nonsense sale. They would present a cash offer based on their algorithm and close on a mutually agreed-upon date. After closing, Zillow would turn these properties around with some improvements and bring them back to the market. This is often labeled a “flip”. The problem was Zillow overpaid for the majority of their purchases which proved that their computer-generated evaluation (AVM) lacks market accuracy.

On average, they re-sold these homes for $80,800 less than what they purchased them for. Thorough market research that includes touring the subject and neighboring properties, seeking info from other brokers about the terms of recent sales and overall experience helps to determine accurate market conditions in comparison to the swirl of data used to establish the Zestimate. Computers can’t do this type of in-depth research, nor do they have the instinct to predict shifts in the market, but humans (real estate brokers) can!

Often times when I am talking with potential sellers, their Zestimate (or other AVMs) come up in the overall conversation. I understand why, too. This is information that is relatively easy to access and gives the seller a starting point on the value of their home. Where an AVM can become dangerous is when a consumer thinks it’s the be-all, end-all. Even worse, when a consumer makes a major financial decision solely based on this information. According to Zillow, 39% of all Zestimates in the Seattle metro area are not within 5% of the actual value. In fact, they publish an accuracy report that you can access here.

In October, the median home price in the Seattle Metro area was $850,000. With 39% of all Zestimates not within 5% of the actual value, that is a beginning margin of error of $42,500! Further, they claim that 82% of their Zestimates are within 10% of the actual value, which is a marked difference – up to $85,000. Where AVMs are incomplete is that the basis of their formula is tax records, which in my experience are often inaccurate. Also, and most importantly, an AVM does not take into consideration the condition of the home, the neighborhood, and other environmental impacts such as school district, road noise, and unsightly neighboring homes, to name a few.

So why does the Zestimate exist? Zillow is a publicly-traded company (ZG) and their website is the vehicle to create profit. The Zestimate drives consumers to the website who are often dipping their toes in the pool to see what their home might be worth or searching available homes for sale. When a consumer is searching on Zillow’s website they are surrounded by real estate broker and mortgage broker ads on every page. These real estate brokers and mortgage brokers are paying for that advertising space, which is how Zillow makes its money and why there is a Zestimate. The Zestimate is not a public service, it is a widget to bring eyes to their advertising space which in turn, sells more ads to brokers looking for leads.

The moral of the story is this: use Zillow as one of the many tools in your real estate evaluation and search toolbox. Zillow provides a great starting point and contains a ton of information to whet your palate when embarking on a real estate endeavor. However, we live in a time of information overload and we are overstimulated at best. Nothing beats the evaluation and discernment of a knowledgeable and experienced real estate broker to help you determine accuracy, which will lead to the empowerment of clarity. At Windermere, we like to call this, The Human Algorithm.

If you are curious about the value of your home in today’s market, please contact me. I can provide an annual real estate review of all of your real estate holdings, and can even dive deep into a complete comparative market analysis if you would find that helpful. It is my goal to help keep my clients informed and empower strong decisions.

Zillow® and Zestimate® are trademarks of Zillow, Inc.

Matthew Gardner is the Chief Economist at Windermere and a sought-after expert on real estate, both locally and across the country. Every quarter, Matthew breaks down the real estate market by region and provides the Gardner Report; you can read this quarter’s full report here.

If you have any questions or curiosity about the current real estate market that you would like to discuss, please reach out. Are you curious about the value of your home, are you contemplating a move, or considering a new purchase? I can help! It is always my goal to help empower my clients to make strong financial decisions and to help them understand how real estate can positively affect their lifestyle.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

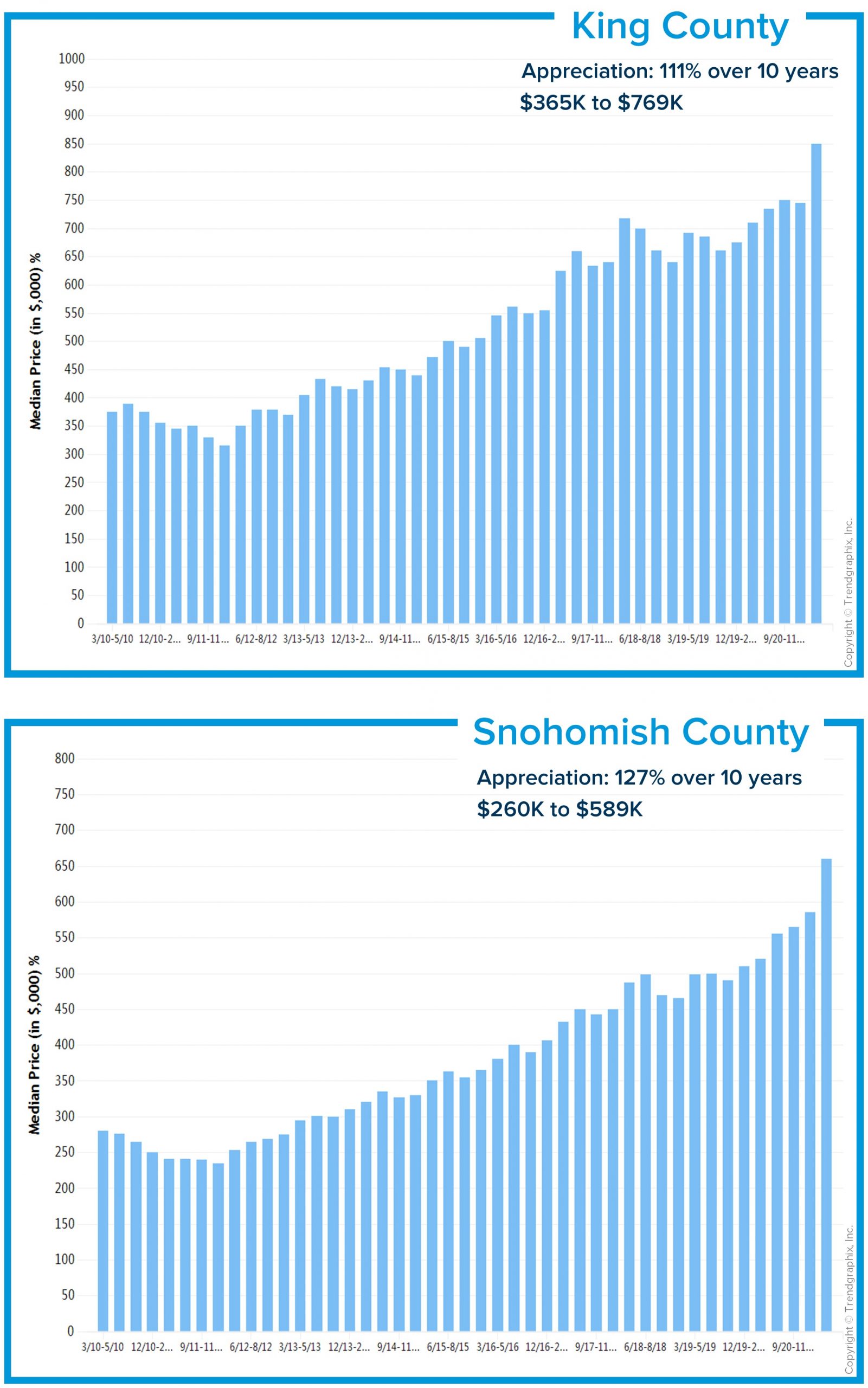

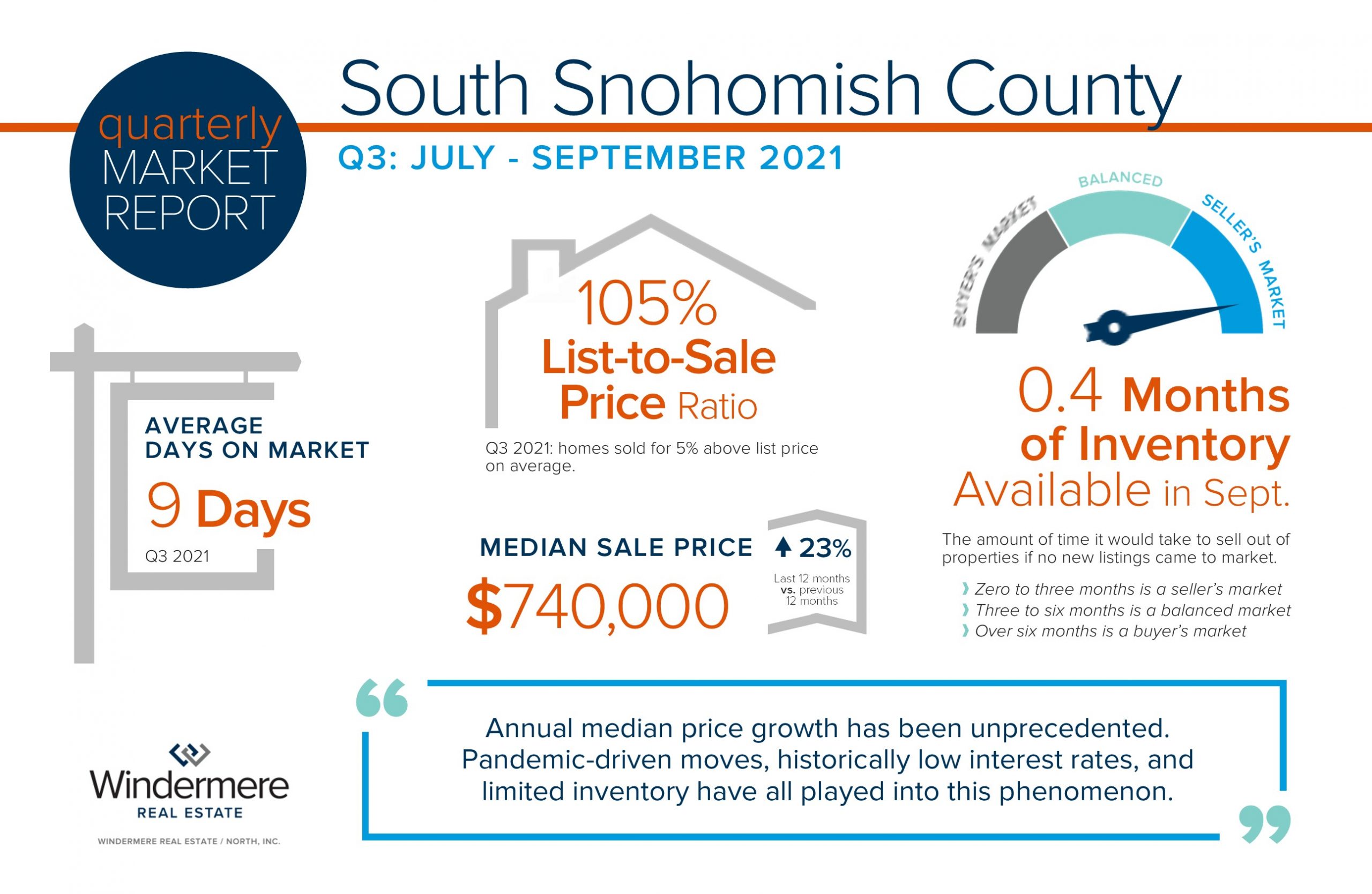

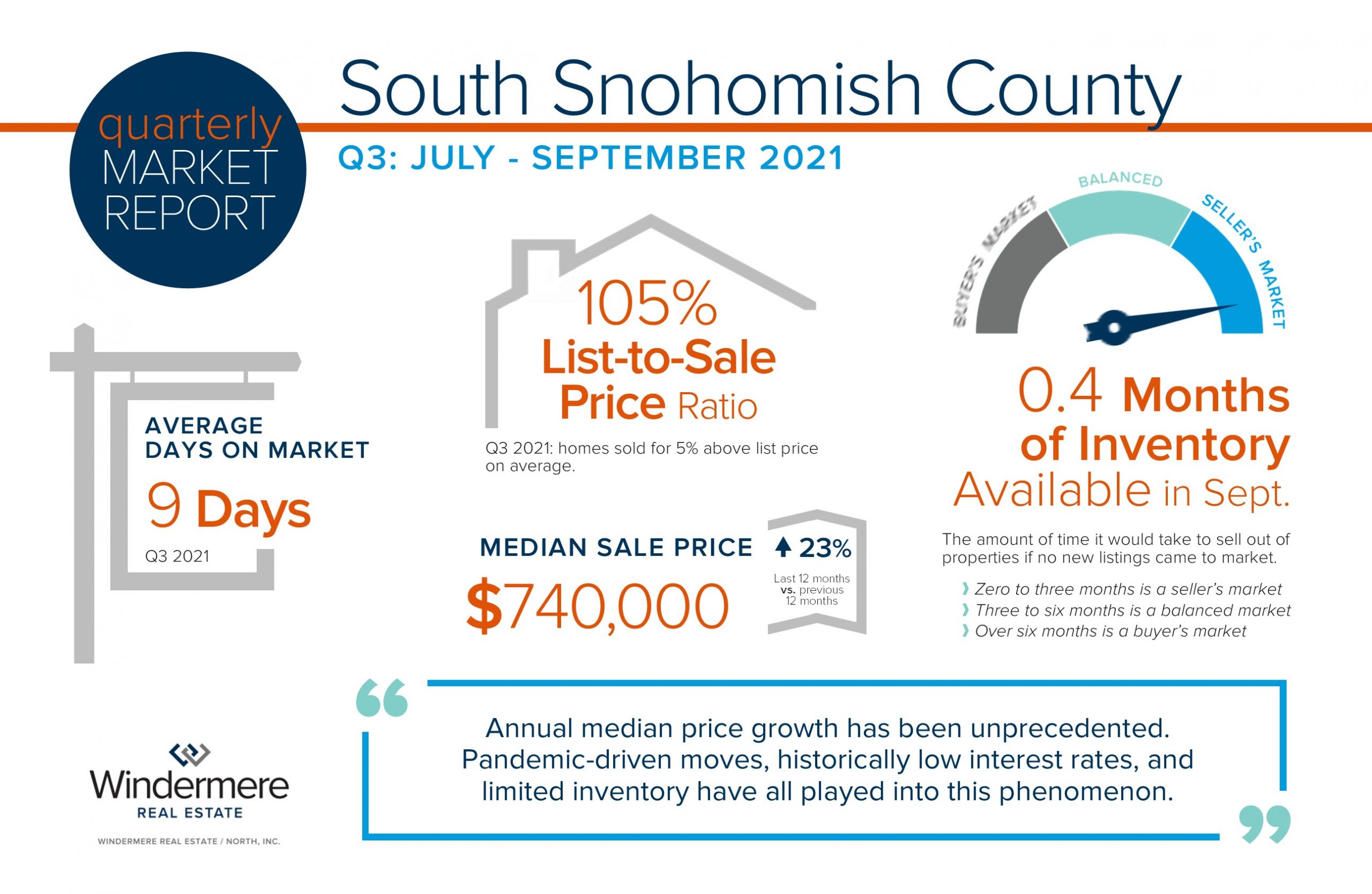

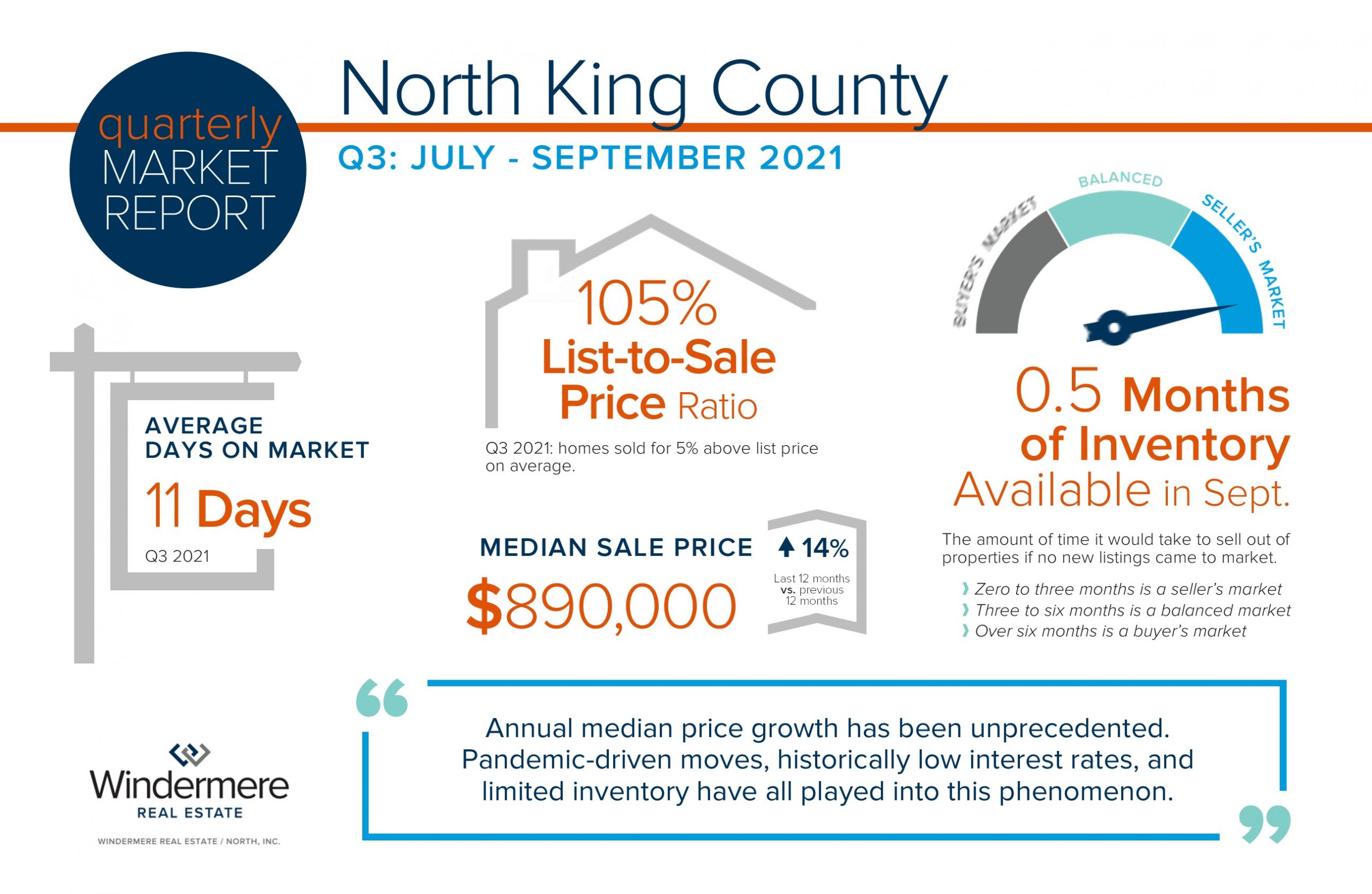

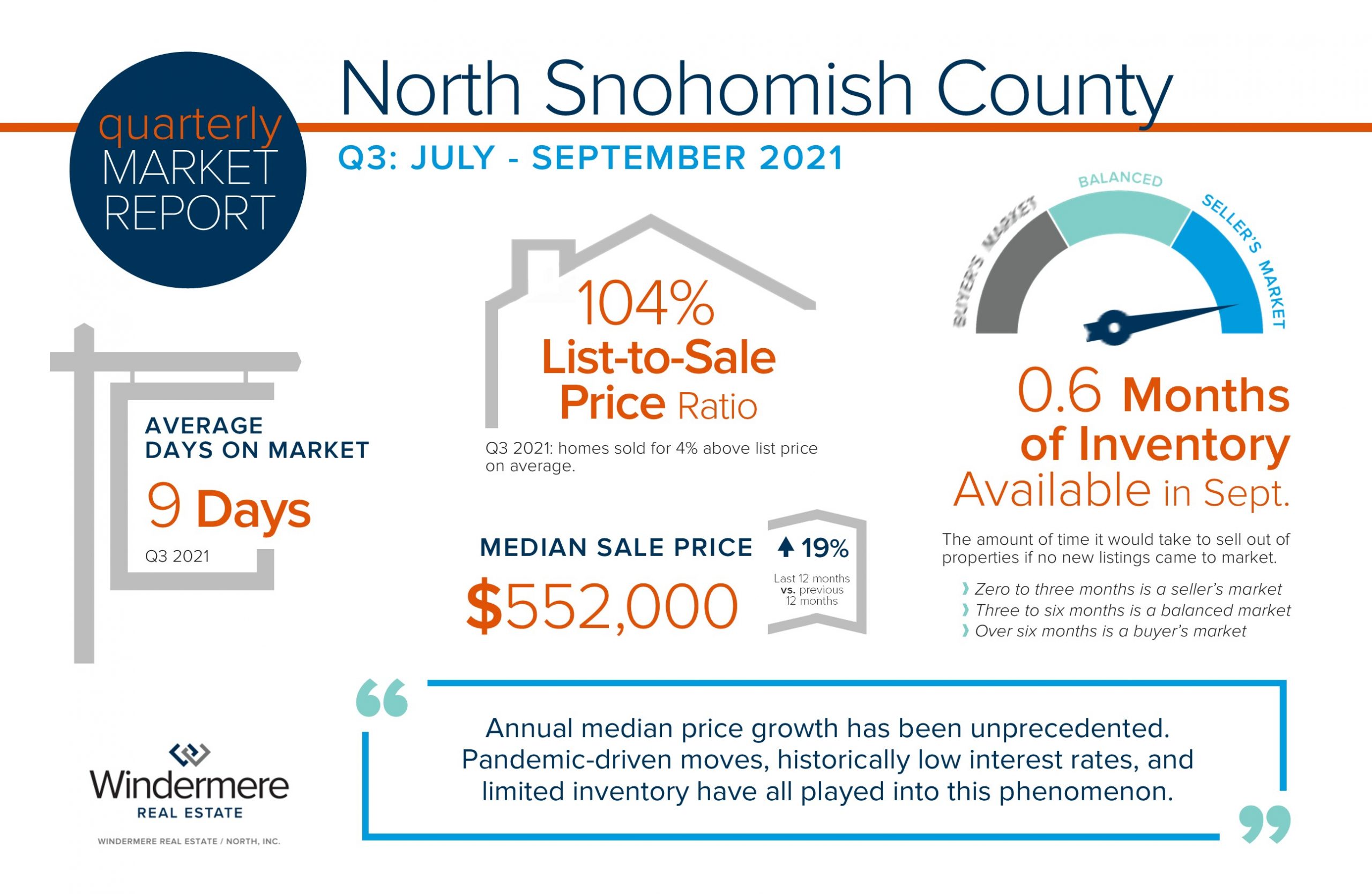

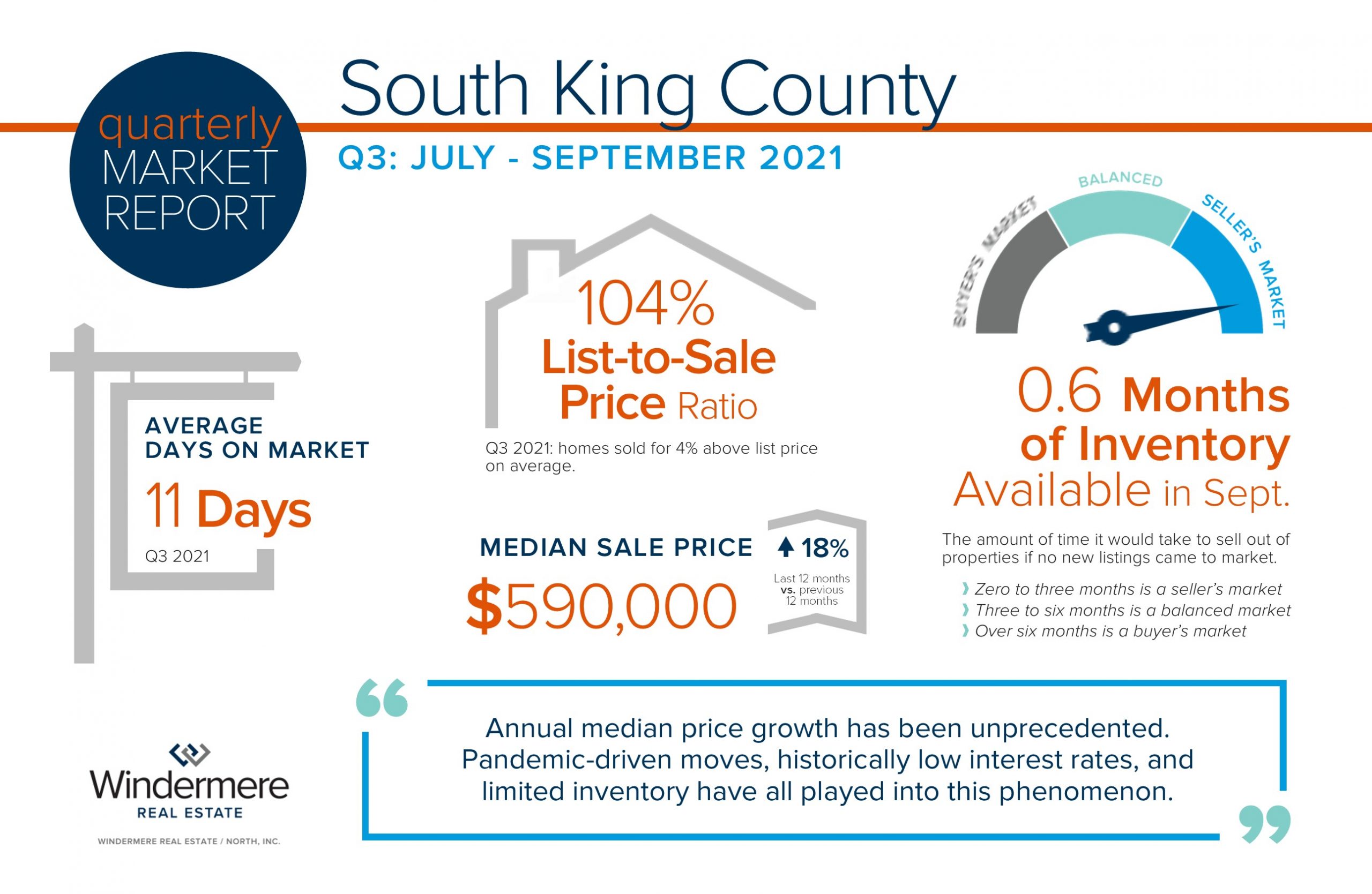

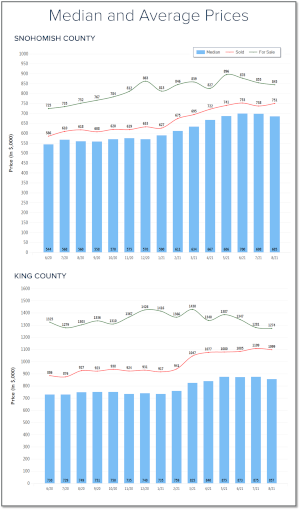

Buyers having a well-thought-out plan is paramount to finding success in today’s market. Partnering with their broker to assess their budget and how it relates to the location(s) and features they desire is the strategic formula that helps a buyer gain clarity. Buyer clarity is what leads a buyer to be able to make a sound decision to offer on a home. If a buyer is not clear, they will not be empowered to make a decision; in turn elongating the process and costing them more money. We have seen intense price growth since the beginning of the year illustrating the cost of waiting. In King County median price is up 16% year-over-year and up 21% in Snohomish County.

Buyers having a well-thought-out plan is paramount to finding success in today’s market. Partnering with their broker to assess their budget and how it relates to the location(s) and features they desire is the strategic formula that helps a buyer gain clarity. Buyer clarity is what leads a buyer to be able to make a sound decision to offer on a home. If a buyer is not clear, they will not be empowered to make a decision; in turn elongating the process and costing them more money. We have seen intense price growth since the beginning of the year illustrating the cost of waiting. In King County median price is up 16% year-over-year and up 21% in Snohomish County.

Since January the median price in Snohomish County has increased by 16% and in King County by 17%. Prices peaked in Snohomish County in June with the median price at $700,000 and in July in King County at $875,000. In August, both counties recorded prices 2% off the peak but were still sitting on top of a heap of price growth since the first of the year. Historically, markets will peak in the late spring, early summer as the ceiling of pricing starts to find itself. That appears to be where we are at. Although the figures this year have been intense and well above the norm, it is comforting to see typical seasonality still happening.

Since January the median price in Snohomish County has increased by 16% and in King County by 17%. Prices peaked in Snohomish County in June with the median price at $700,000 and in July in King County at $875,000. In August, both counties recorded prices 2% off the peak but were still sitting on top of a heap of price growth since the first of the year. Historically, markets will peak in the late spring, early summer as the ceiling of pricing starts to find itself. That appears to be where we are at. Although the figures this year have been intense and well above the norm, it is comforting to see typical seasonality still happening.