On April 23rd the Washington State Legislature adjourned after passing 10 new bills that will affect housing. Some of the bills are geared toward creating more transparency around brokerage transactions, some are intended to institute more opportunities for building density to provide more affordable housing, and some are more regulatory to help guide and ease the permitting process for building and development.

The bills that will improve real estate brokerage services are centered in transparency and cleaning up some laws that do not trend with market conditions. As of January 1, 2024, all real estate brokers will be required to engage in a buyer service agreement with the buyers they work with, similar to the requirement of having a listing agreement with a seller (SB 5191). These service agreements, better known as Buyer Agency Agreements (BAA) will address compensation, exclusivity, the duration of the relationship, and establish written consent for dual agency. This will create clearly defined broker representation for buyers from the onset of the relationship.

Short-term seller rent-backs after closing are now carved out of the landlord-tenant act if the rent-back is less than 90 days (SHB 1070). This will ease the angst involved with tenant rights, as the goal of a rent-back is to create a convenient transitionary period that intends for the seller to vacate, minimizing their tenant rights. This change aligns with the trends in the marketplace and makes this solution-based approach less tenuous. Lifetime listing agreements were also shortened (SSB 5399).

Washington State ranks last in the number of housing units per family nationally and officials project that the state will need roughly one million new homes by 2044. Many of the bills that passed last month will create policies to help provide more housing units and affordability. Matthew Gardner, Windermere’s Chief Economist has been speaking about our state’s lack of affordability for years and shares his thoughts here on the HB 1110 which will allow for the development of middle housing.

HB 1110, SB 5258, HB 1042, and HB 1337 were all created to create more housing units. HB 1110 addresses middle housing, SB 5258 modifies several laws relating to the construction of condos and townhomes, HB 1042 enables the creation of housing in existing, underutilized buildings, and HB 1337 will make it easier to build Accessory Dwelling Units (ADUs) in urban growth areas.

SB 5412, SB 5290, and HB 1293 are intended to ease the permitting and design review processes when applying for a building permit. These should help streamline and accelerate getting from point A to point B on a building project. With the goal of providing more housing units, the backend systems needed to be reevaluated to meet these goals in a timely fashion while adhering to important guidelines and procedures.

Lastly, HB 1474 will increase the document recording fees by $100 to fund a new state program to provide down payment and closing cost assistance to people, or heirs, impacted by racially restrictive covenants. This program is set to raise $75 million per year to improve housing affordability. The State also committed over $1.1 billion in budget funds to work towards investing in housing supply and homelessness prevention.

Click here for a detailed review of each new bill and the budget changes. It is always my goal to help keep my clients well-informed about the real estate market and in this case, knowing the direction our state is headed with the laws surrounding real estate and housing. If you have additional questions or want to discuss how these changes may affect your housing goals, please reach out.

ATTENTION GARDENERS: Windermere Community Service Day is coming and we’d love your help!

ATTENTION GARDENERS: Windermere Community Service Day is coming and we’d love your help!

Since 1984, Windermere associates have dedicated a day of work to complete neighborhood improvement projects as part of Windermere’s Community Service Day. After all, real estate is rooted in our communities. And an investment in our neighborhoods gives us all a better place to call home.

Our office will spend June 9th with the Snohomish Garden Club working to put fresh produce on the tables of local families who need a little help. We will plant over a half-acre of veggies and fruits that will be harvested over the summer and into the fall.

If you’d like to pitch in, we are looking for additional veggie starts. Let us know if you have some starts already going or if you would like to prepare some now that you would be willing to donate.

The garden specifically needs:

- Scallions

- Snow/Pod Peas (please no shelling peas)

- Chard

- Lettuce (the food banks require headed varieties, rather than loose-leaf)

- Squash (any kind, EXCEPT yellow crookneck)

- Cabbage/Broccoli/Kohlrabi/Cauliflower/Collards/Kale

- Peppers (early maturing varieties work great: ~70-day range)

- Herbs (never enough Basil and Parsley!)

- Flowers (marigolds, nasturtiums, or any annuals)

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

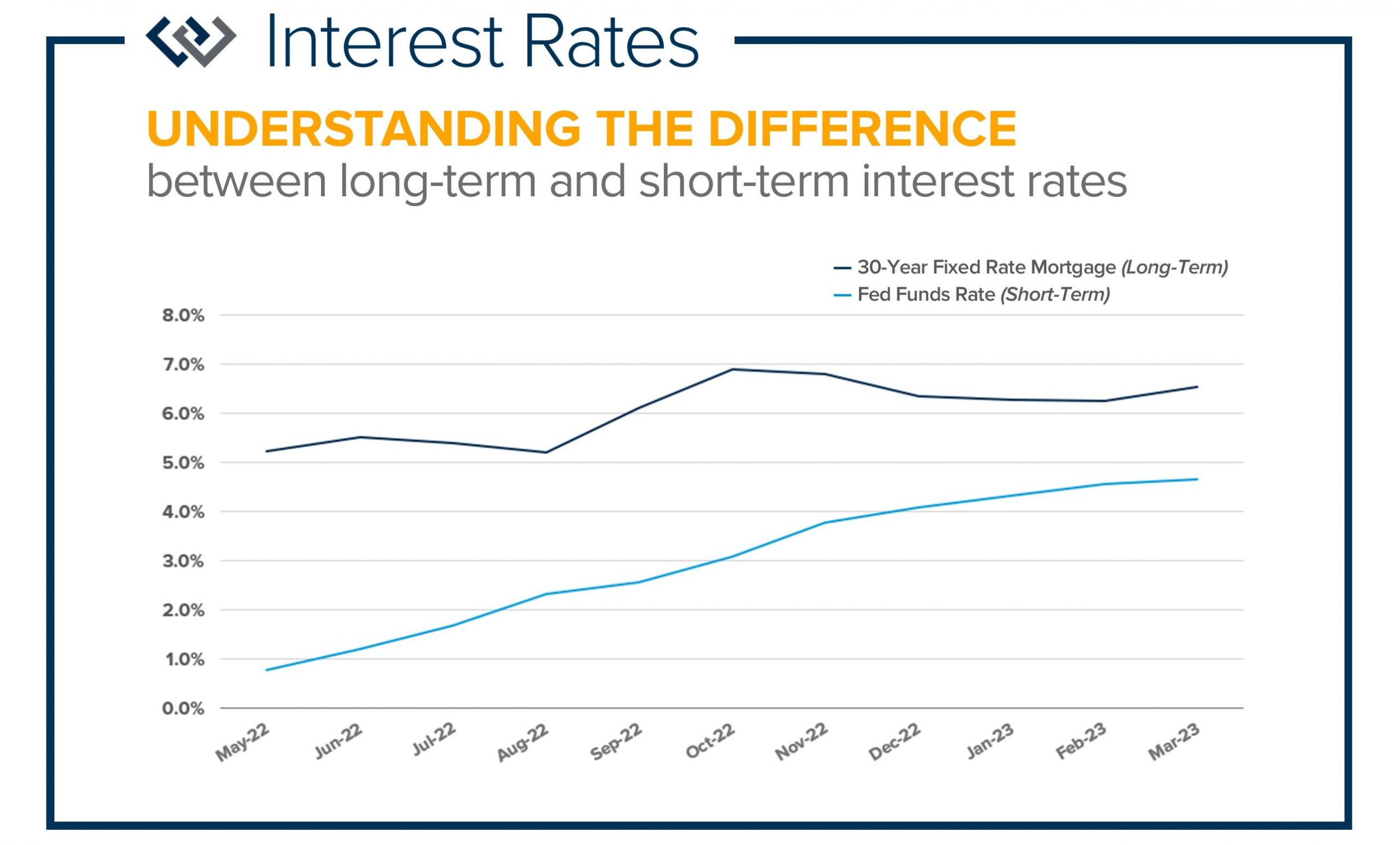

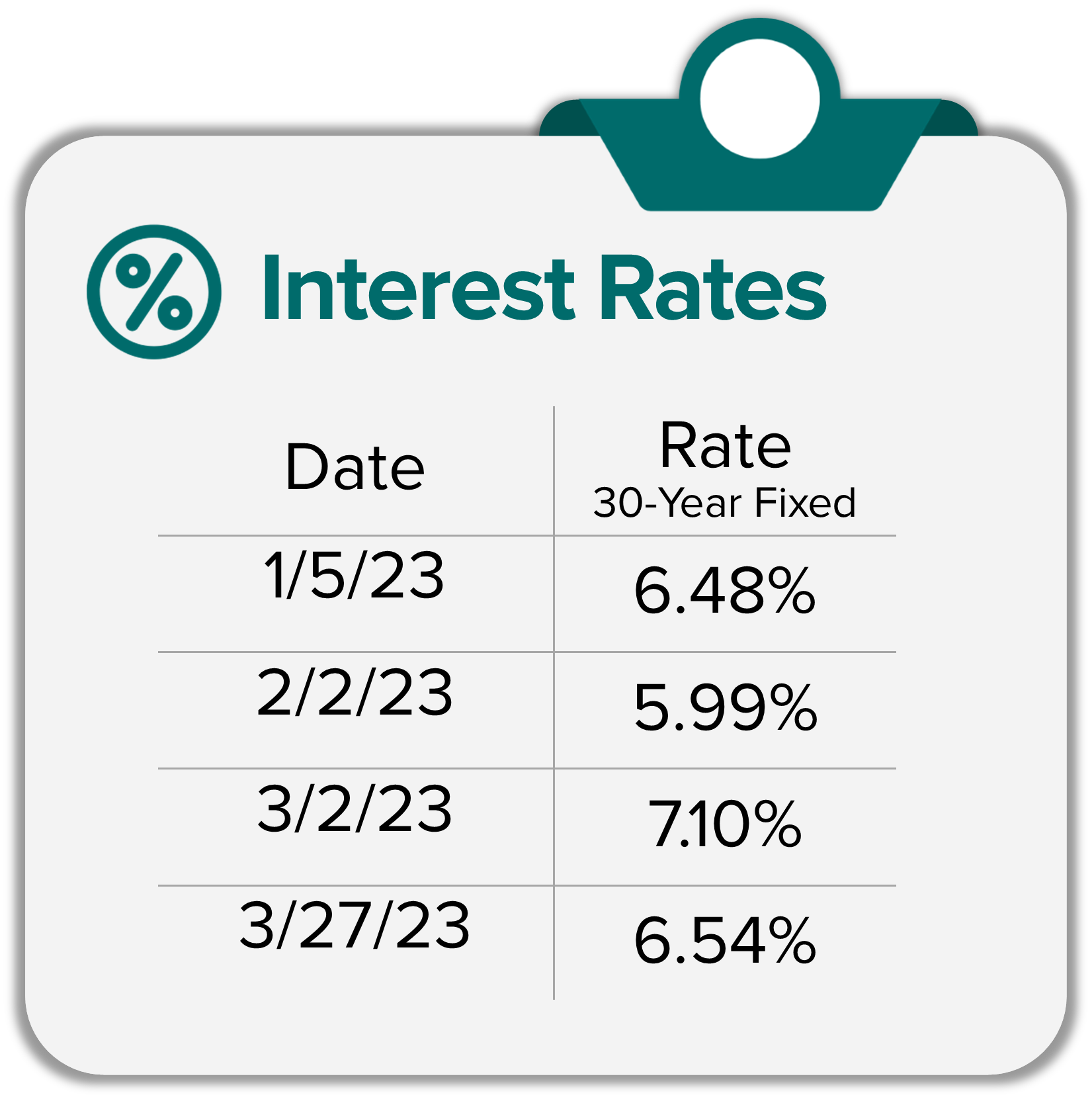

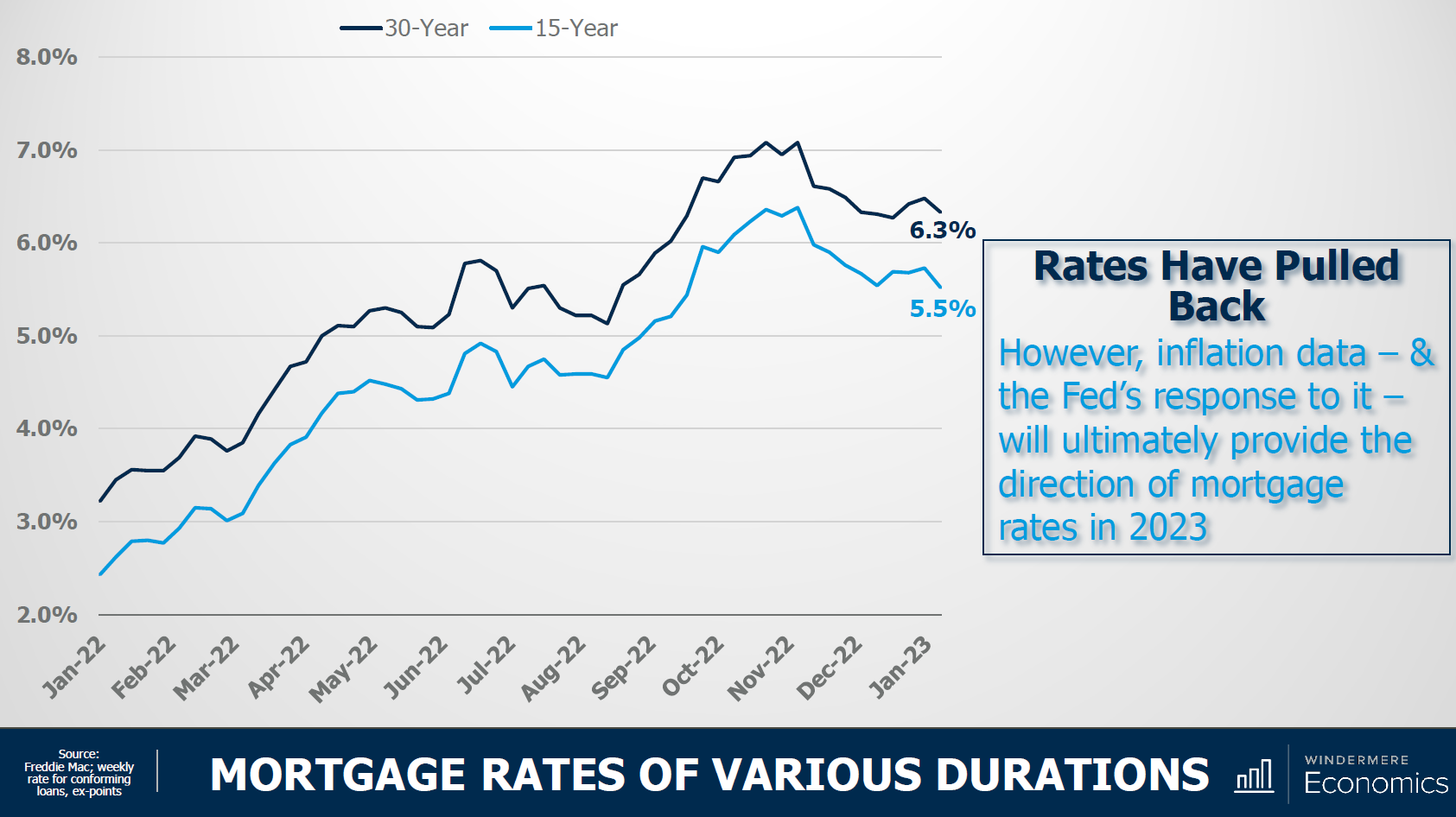

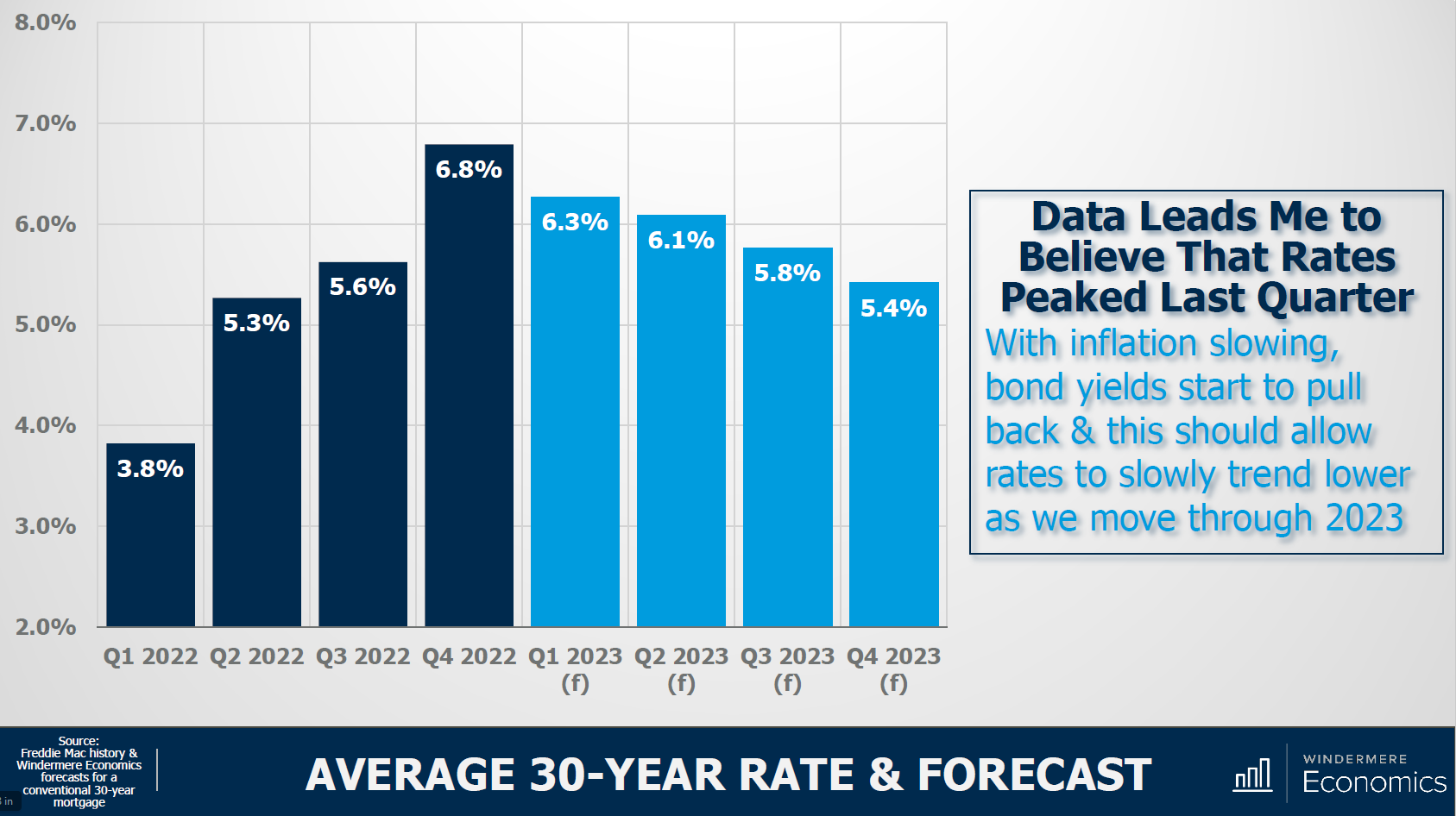

It is very important that consumers understand the difference between long-term interest rates and short-term interest rates. Long-term rates involve home mortgages such a conventional 30-year fixed, Jumbo, FHA, and VA loans. Short-term rates involve car loans, credit cards, and Home Equity Lines of Credit (HELOCs). While both types of rates have gone up over the course of the last year, they have not had the same trajectory.

It is very important that consumers understand the difference between long-term interest rates and short-term interest rates. Long-term rates involve home mortgages such a conventional 30-year fixed, Jumbo, FHA, and VA loans. Short-term rates involve car loans, credit cards, and Home Equity Lines of Credit (HELOCs). While both types of rates have gone up over the course of the last year, they have not had the same trajectory.

ATTENTION GARDENERS: Windermere Community Service Day is coming and we’d love your help!

ATTENTION GARDENERS: Windermere Community Service Day is coming and we’d love your help!

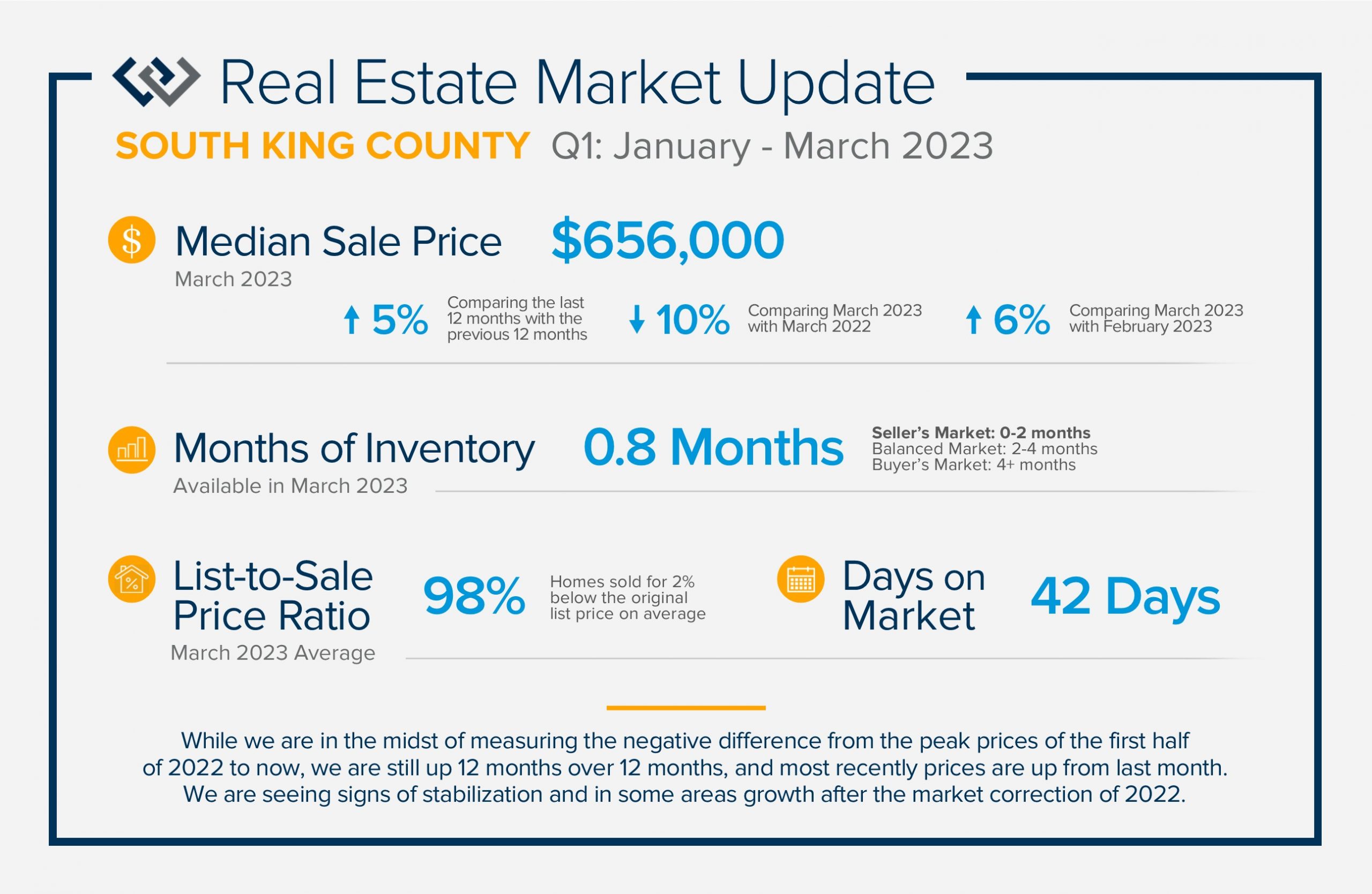

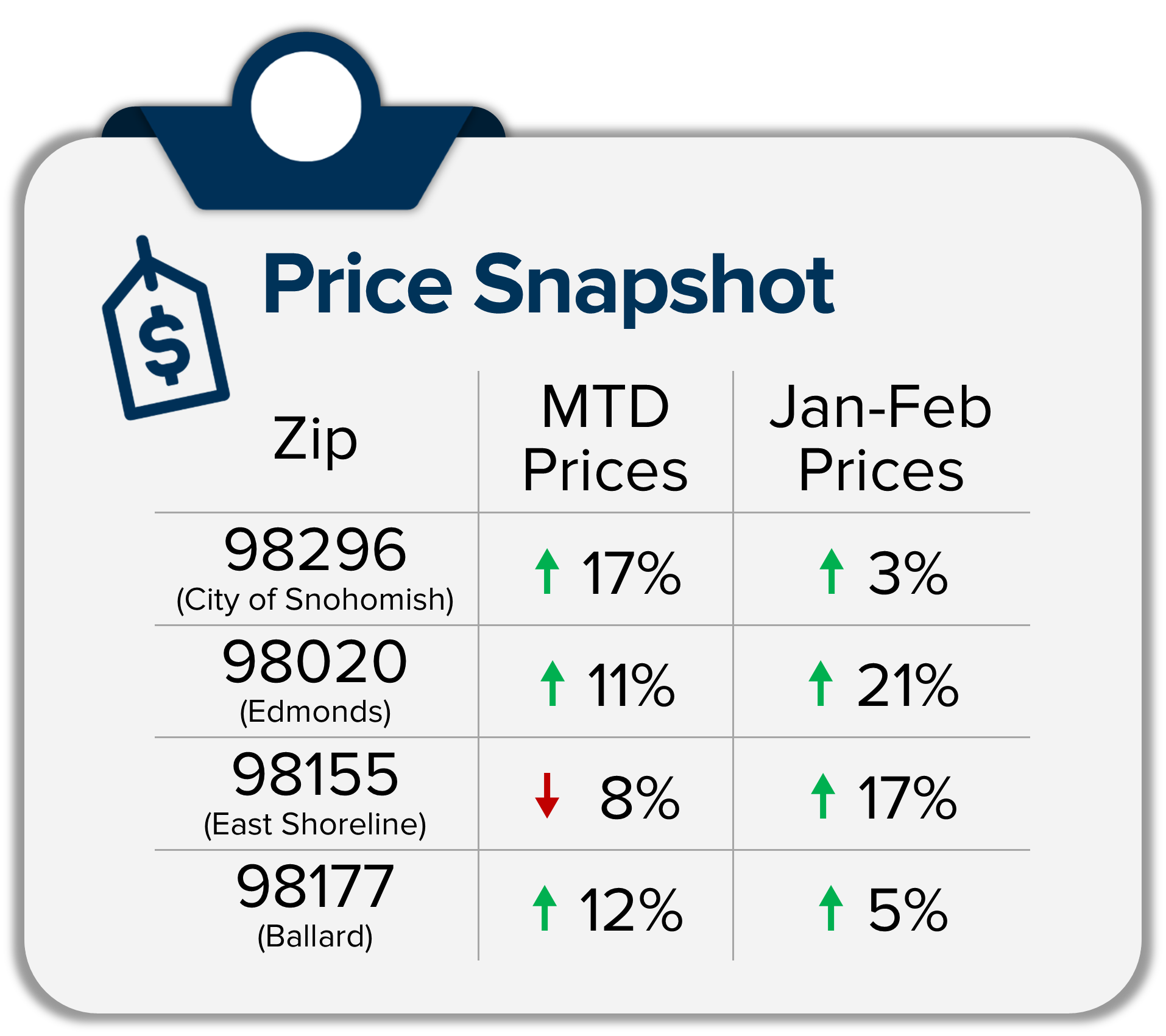

We are seeing signs of price stabilization and some growth after the market correction of 2022! Illustrated on the front is the up-down-up trajectory that home prices have experienced over the last year. While we are in the midst of measuring the negative difference from the peak prices of the first half of 2022 to now, we are still up 12 months over 12 months, and most recently prices are up from last month.

We are seeing signs of price stabilization and some growth after the market correction of 2022! Illustrated on the front is the up-down-up trajectory that home prices have experienced over the last year. While we are in the midst of measuring the negative difference from the peak prices of the first half of 2022 to now, we are still up 12 months over 12 months, and most recently prices are up from last month.

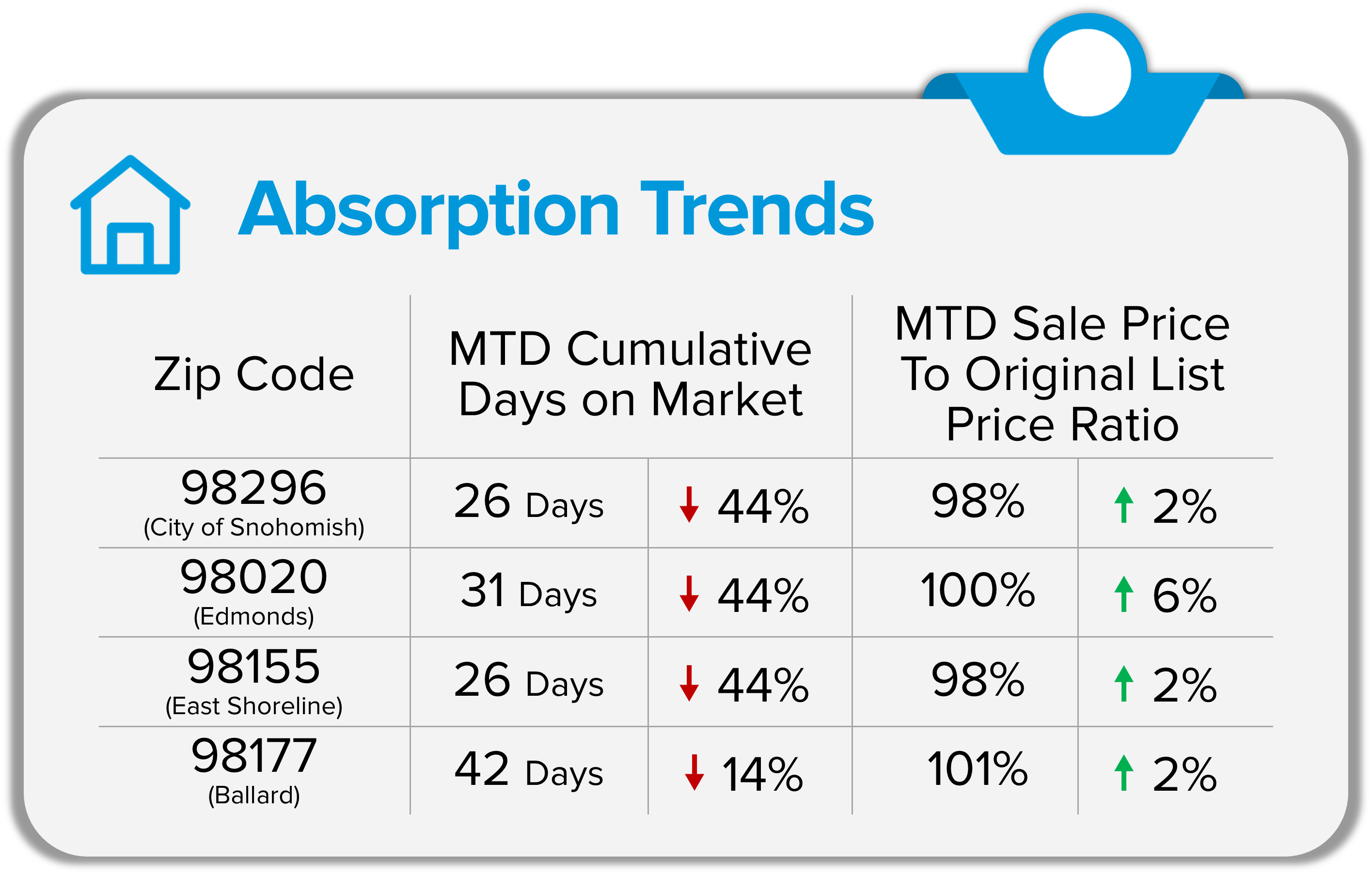

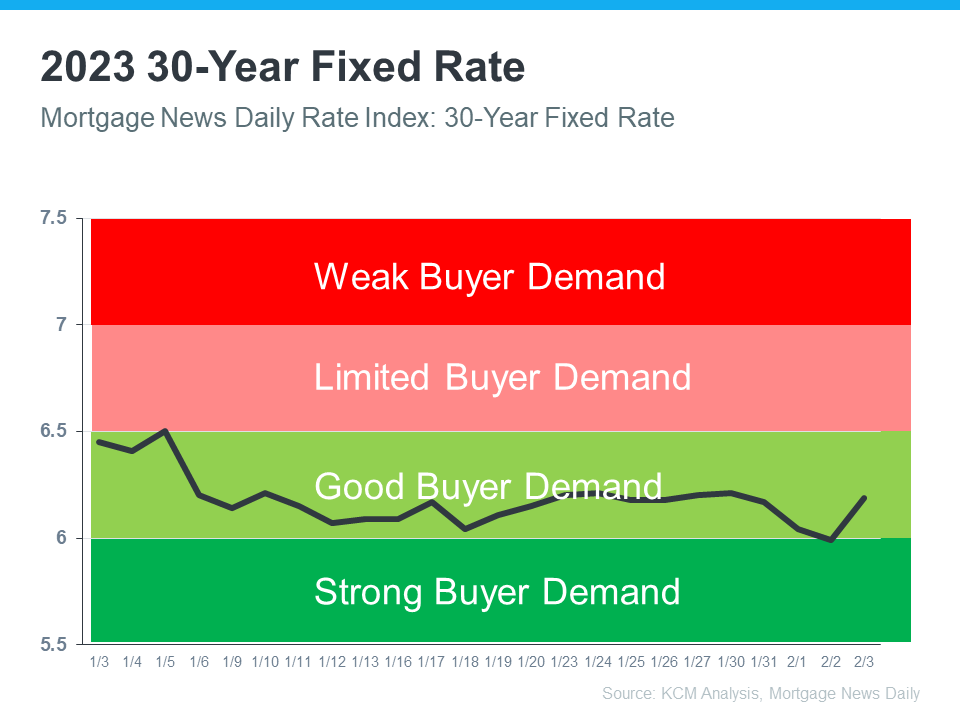

As we round out the first quarter of 2023, three real-time trends to pay close attention to in order to truly understand what is happening in the real estate market are absorption data, interest rates, and inventory levels. Right now, we are in the midst of the market heating up due to seasonality, pent-up buyer demand, and rates finding their new normal. The media will often lag in reporting the latest information (pending sale data) and will latch onto closed sale data, which is outdated. I am here to keep you on the frontline of market activity so you are connected to the most current data to keep you well informed.

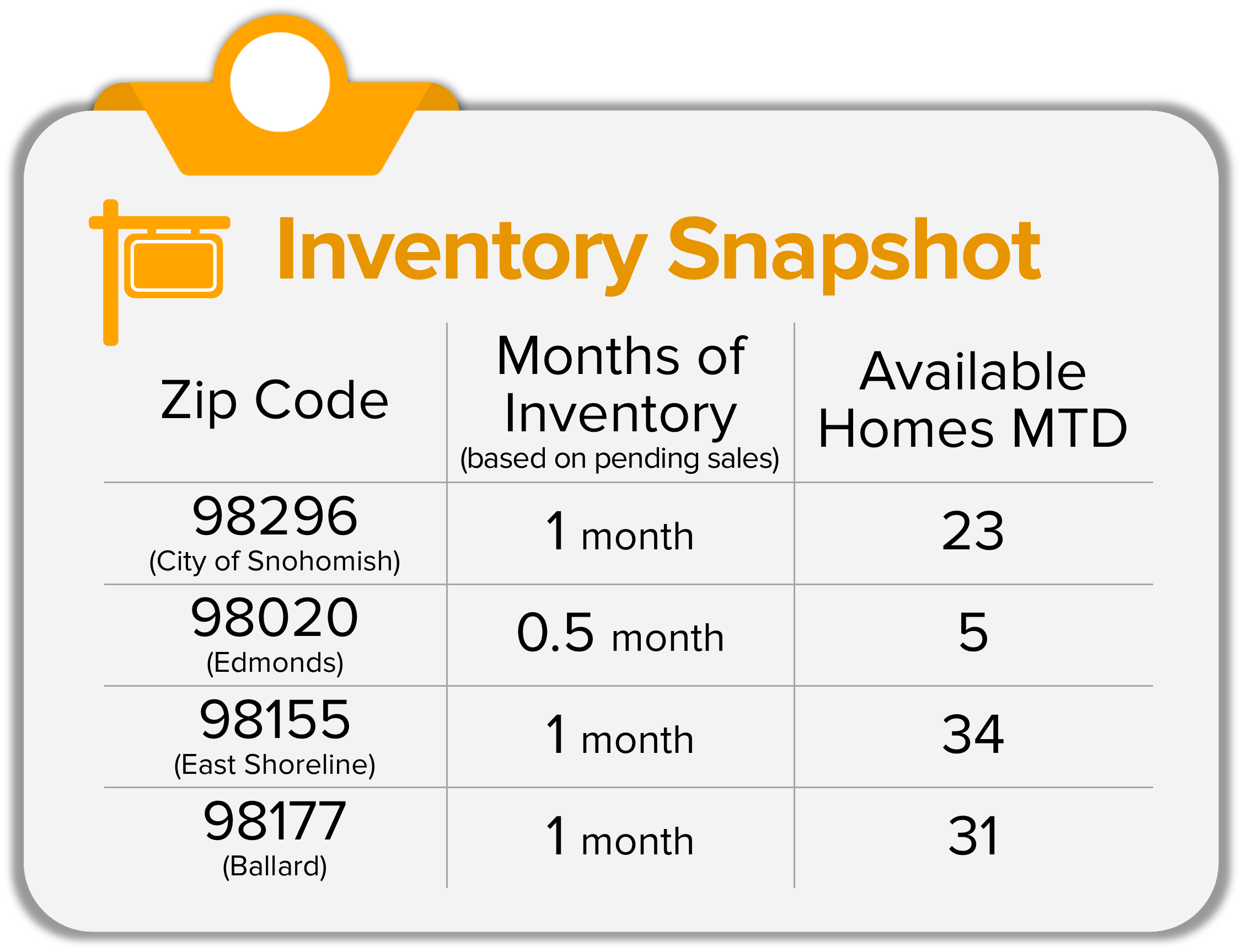

As we round out the first quarter of 2023, three real-time trends to pay close attention to in order to truly understand what is happening in the real estate market are absorption data, interest rates, and inventory levels. Right now, we are in the midst of the market heating up due to seasonality, pent-up buyer demand, and rates finding their new normal. The media will often lag in reporting the latest information (pending sale data) and will latch onto closed sale data, which is outdated. I am here to keep you on the frontline of market activity so you are connected to the most current data to keep you well informed. Available inventory is constricting due to an increase in absorption and new listings lagging. As we head into spring, we will see a seasonal uptick in new listings which will be welcomed by a healthy buyer audience. Month-to-date, inventory levels based on pending sales show a seller’s market (0-2 months). You calculate months of inventory by taking the number of available homes and dividing it by the number of pending sales. If no new homes came to market the trend suggests we would sell out of homes in this amount of time. Month-to-date the actual number of homes available in each zip code is quite limited and a welcome sign for more new listings as we head into Spring. Again, I pulled the data for the four zip codes to represent a sampling of both Snohomish and King Counties.

Available inventory is constricting due to an increase in absorption and new listings lagging. As we head into spring, we will see a seasonal uptick in new listings which will be welcomed by a healthy buyer audience. Month-to-date, inventory levels based on pending sales show a seller’s market (0-2 months). You calculate months of inventory by taking the number of available homes and dividing it by the number of pending sales. If no new homes came to market the trend suggests we would sell out of homes in this amount of time. Month-to-date the actual number of homes available in each zip code is quite limited and a welcome sign for more new listings as we head into Spring. Again, I pulled the data for the four zip codes to represent a sampling of both Snohomish and King Counties. At the start of 2023, the 30-year fixed mortgage was at 6.48%, then dropped to 5.99% in early February, peaked at 7.1% in early March, and is now back down to 6.54% at press time. Rates have been volatile as the Fed tries to manage inflation. You can access a video below from

At the start of 2023, the 30-year fixed mortgage was at 6.48%, then dropped to 5.99% in early February, peaked at 7.1% in early March, and is now back down to 6.54% at press time. Rates have been volatile as the Fed tries to manage inflation. You can access a video below from  During this time of change, it is important that each neighborhood and price point is researched individually. From the four zip code breakdowns above, it is clear that the trends vary. When I am asked the question, “How’s the Market?”, I am always curious to know what you have heard and what you want to learn about. Sweeping statements are dangerous and I am committed to diving into the data to educate my clients on how the trends affect their investments and their lifestyle.

During this time of change, it is important that each neighborhood and price point is researched individually. From the four zip code breakdowns above, it is clear that the trends vary. When I am asked the question, “How’s the Market?”, I am always curious to know what you have heard and what you want to learn about. Sweeping statements are dangerous and I am committed to diving into the data to educate my clients on how the trends affect their investments and their lifestyle.

You’re invited to our annual Paper Shredding Event & Food Drive. We partner with

You’re invited to our annual Paper Shredding Event & Food Drive. We partner with

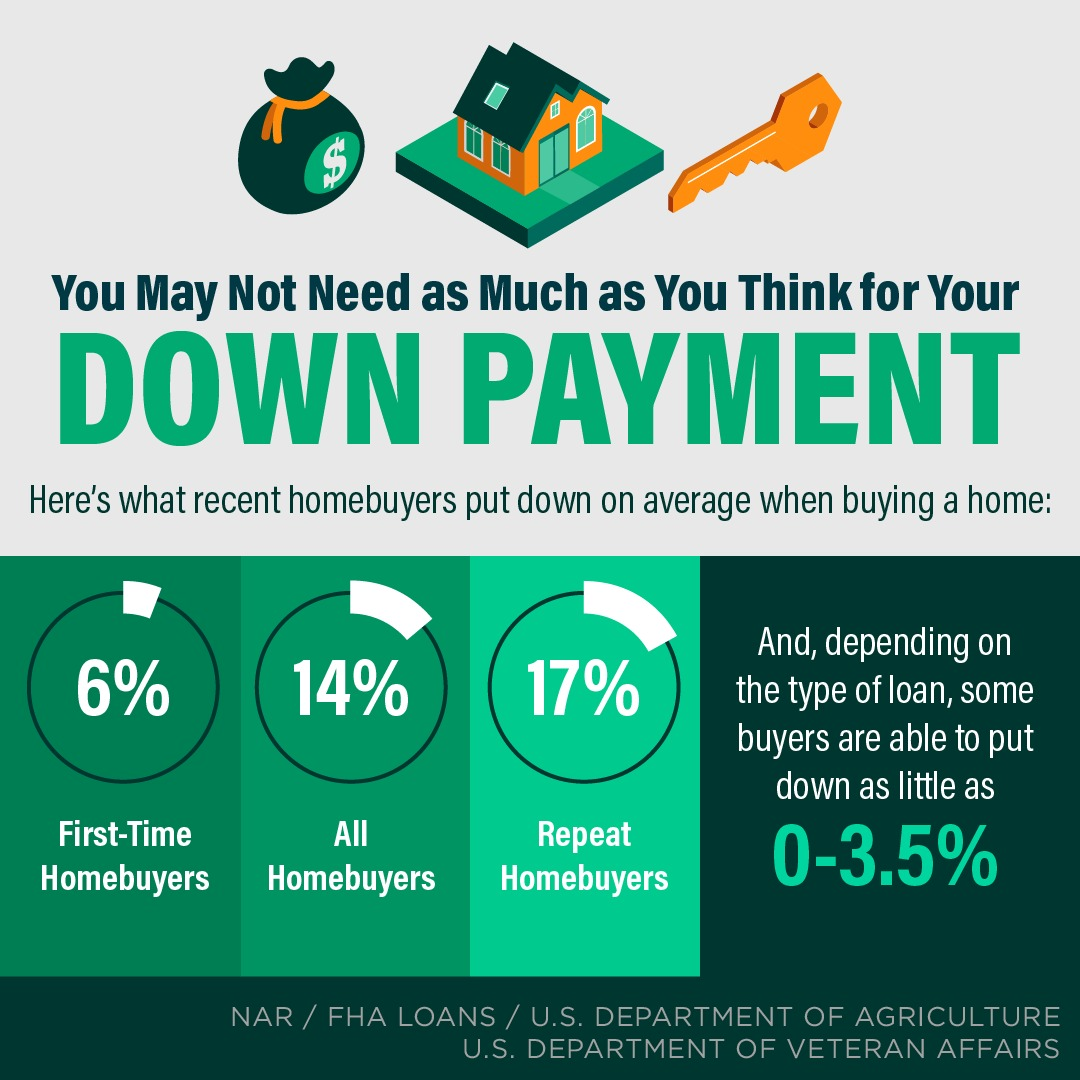

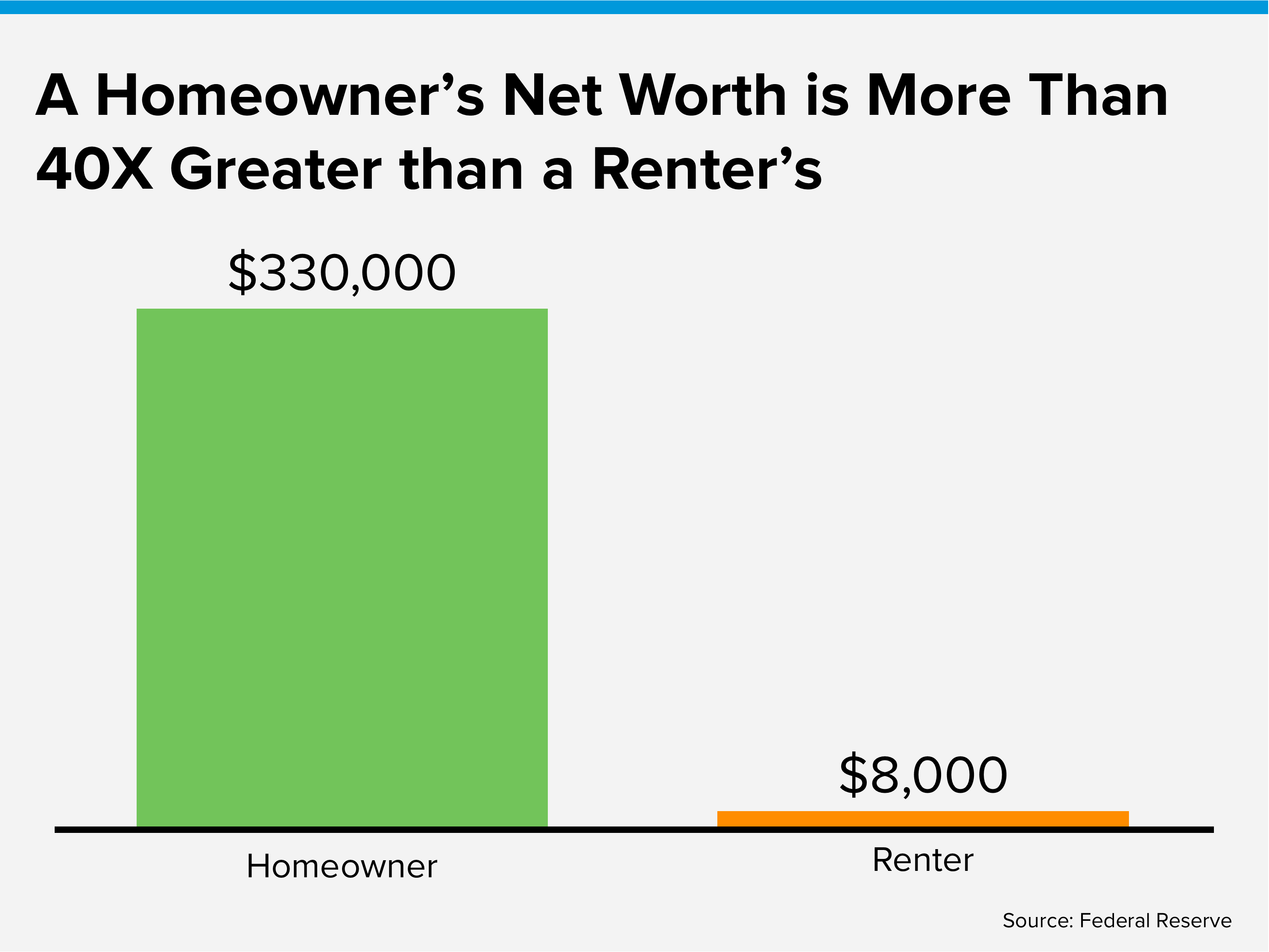

The financial benefits of owning real estate significantly outweigh the option of renting. Renting is certainly a must for some, and is what one may have to do while they build up to becoming a homeowner. Becoming a homeowner requires solid employment, good credit, and some type of down payment. Savings can all be built over time and if achieved can provide incredible long-term financial growth by becoming a down payment on a home. In fact, many people think you need a 20% down payment in order to purchase a home and that is just not the case. There are various loan programs available requiring much less than 20% down.

The financial benefits of owning real estate significantly outweigh the option of renting. Renting is certainly a must for some, and is what one may have to do while they build up to becoming a homeowner. Becoming a homeowner requires solid employment, good credit, and some type of down payment. Savings can all be built over time and if achieved can provide incredible long-term financial growth by becoming a down payment on a home. In fact, many people think you need a 20% down payment in order to purchase a home and that is just not the case. There are various loan programs available requiring much less than 20% down. Owning real estate provides tax benefits. Depending on the state you live in, you can write off your real estate taxes and mortgage interest. This can offset your tax burden and save you significant money every year. There are also capital gains tax exemptions on your primary residence that you have lived in for at least two years of the last 5 years (make sure to consult your tax expert on the details). You can have tax-free gains of up to $250,000 for a single person and up to $500,000 for a married couple. This is a wonderful opportunity to move your wealth towards your future when planning for big lifestyle improvements such as retirement.

Owning real estate provides tax benefits. Depending on the state you live in, you can write off your real estate taxes and mortgage interest. This can offset your tax burden and save you significant money every year. There are also capital gains tax exemptions on your primary residence that you have lived in for at least two years of the last 5 years (make sure to consult your tax expert on the details). You can have tax-free gains of up to $250,000 for a single person and up to $500,000 for a married couple. This is a wonderful opportunity to move your wealth towards your future when planning for big lifestyle improvements such as retirement. You’re invited to our annual Paper Shredding Event & Food Drive. We partner with

You’re invited to our annual Paper Shredding Event & Food Drive. We partner with

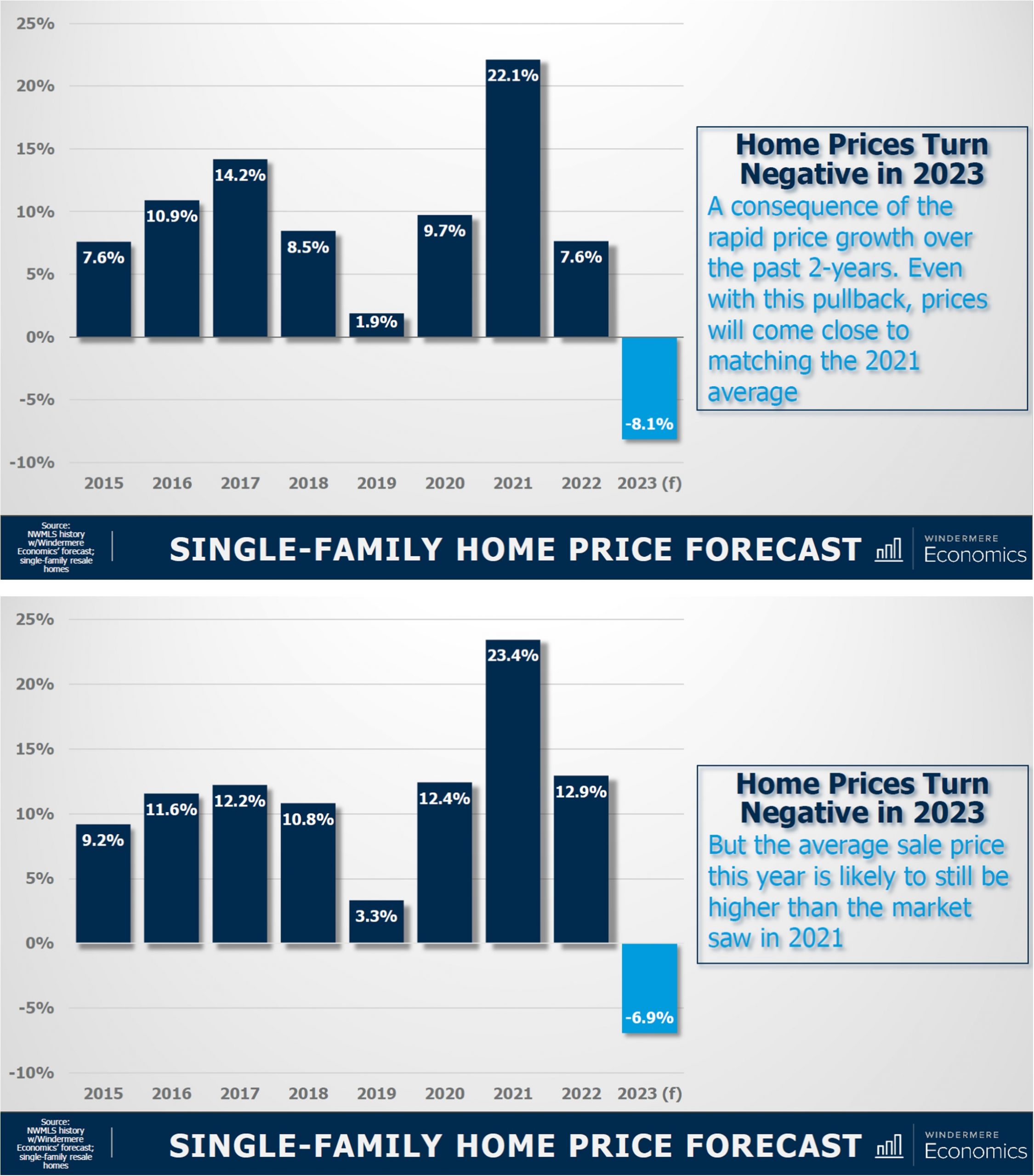

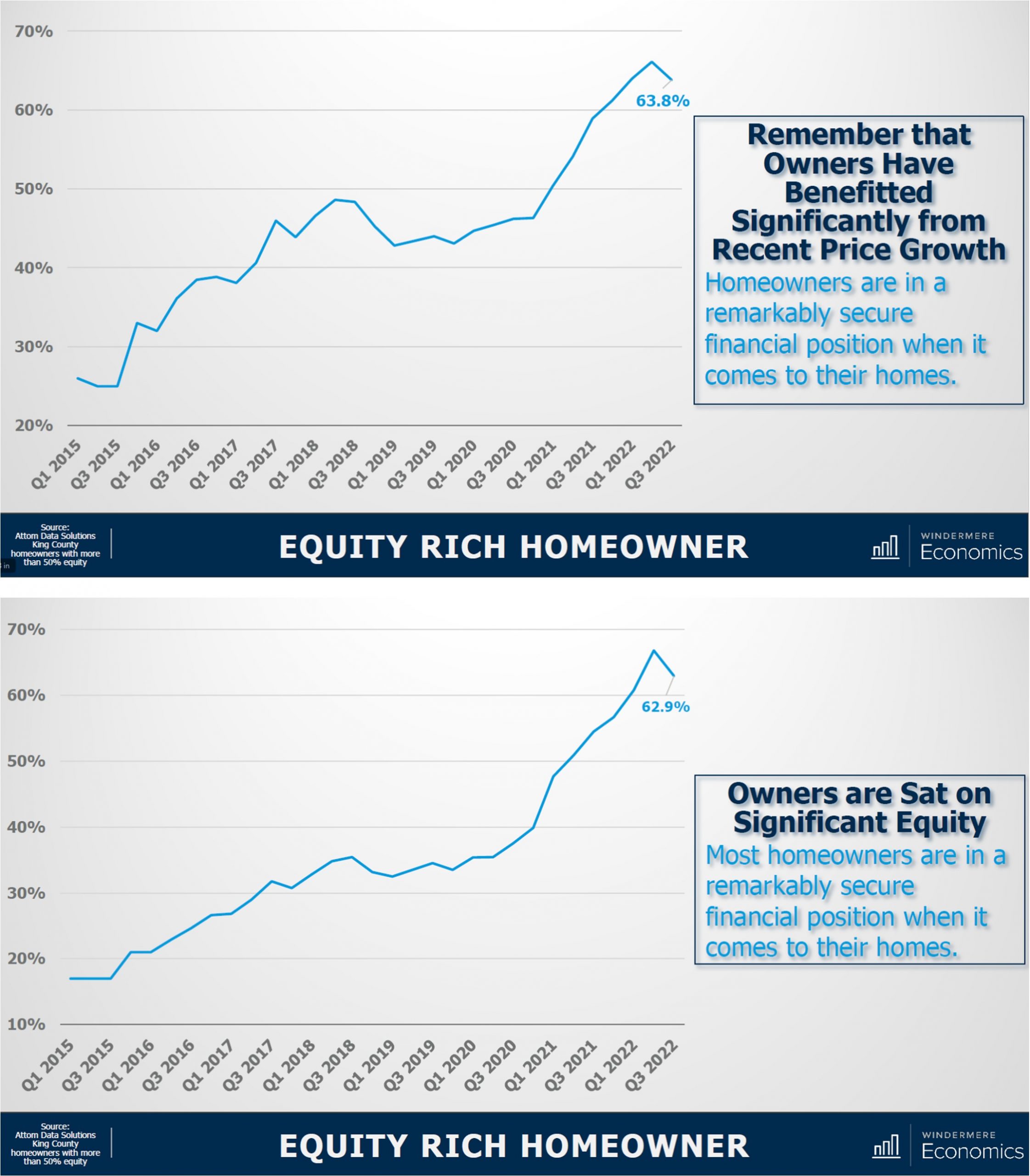

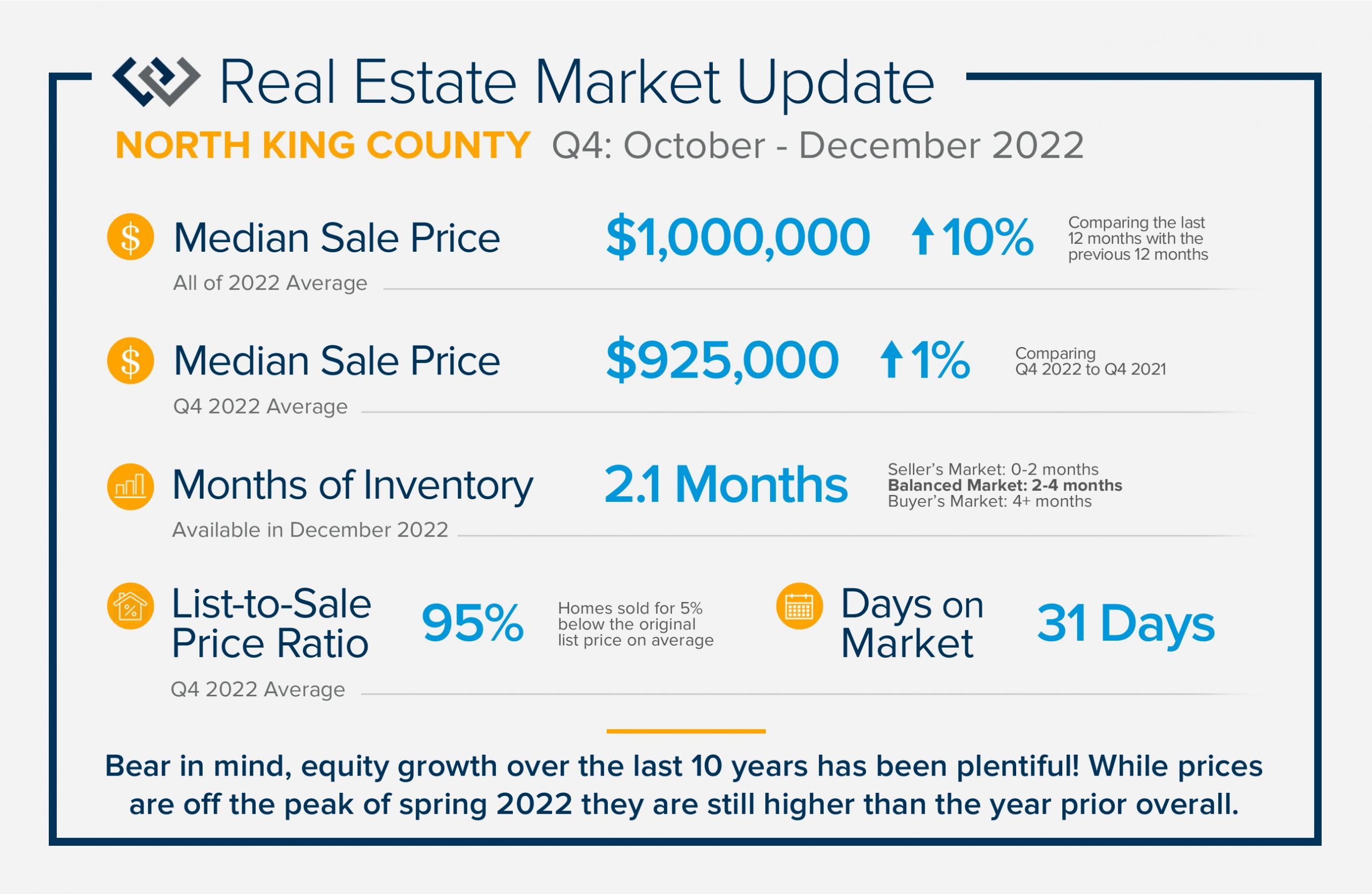

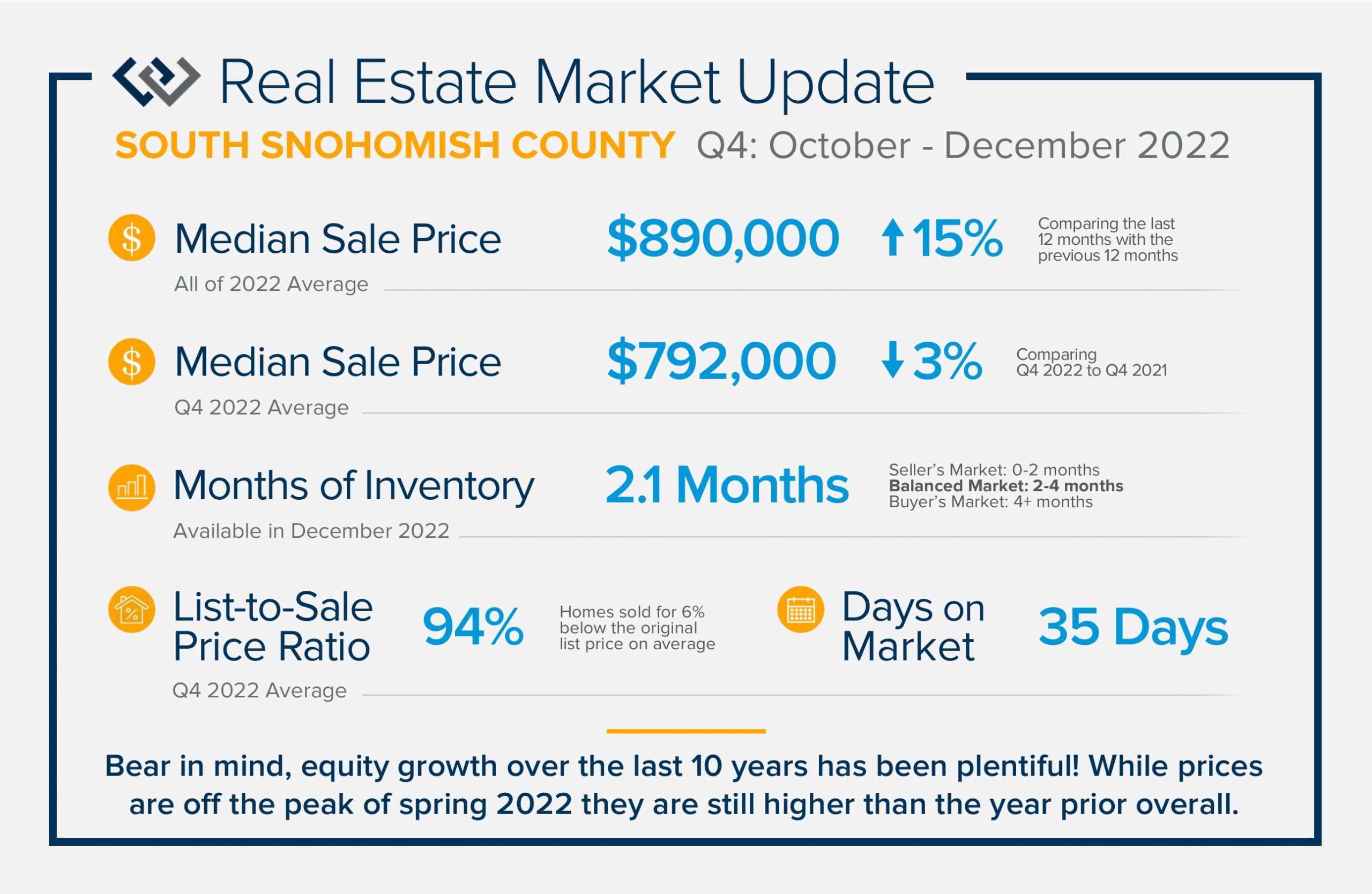

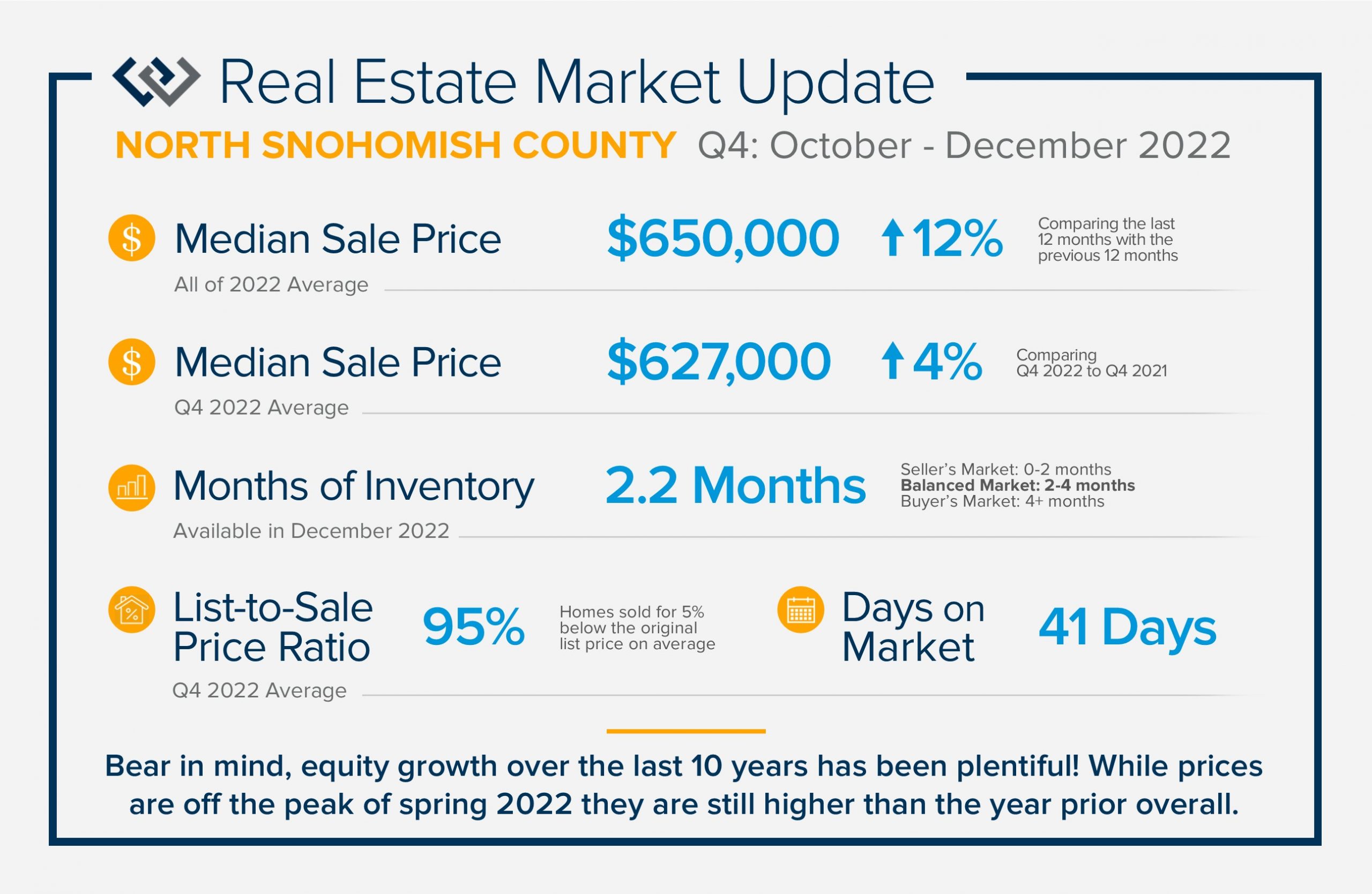

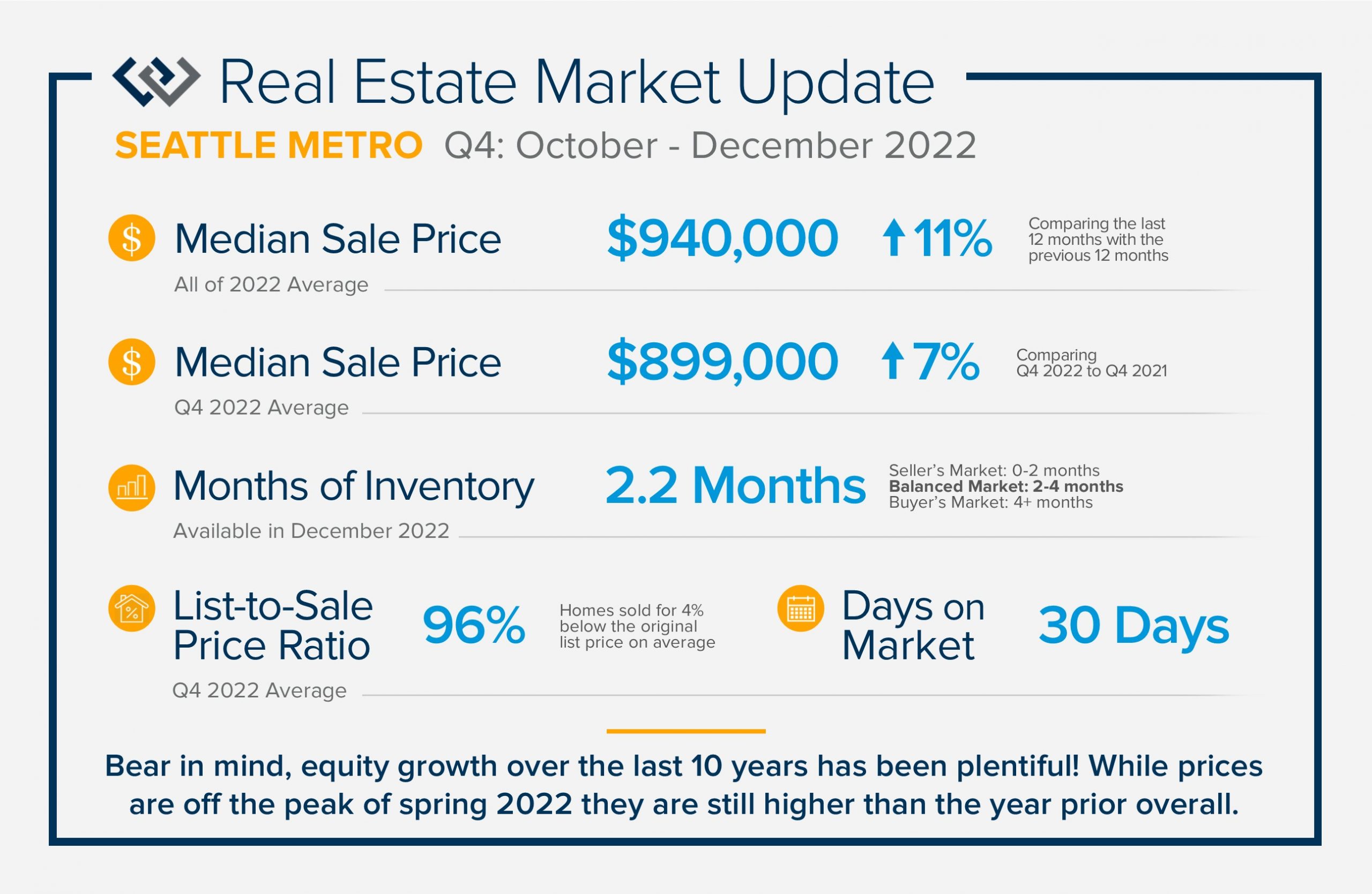

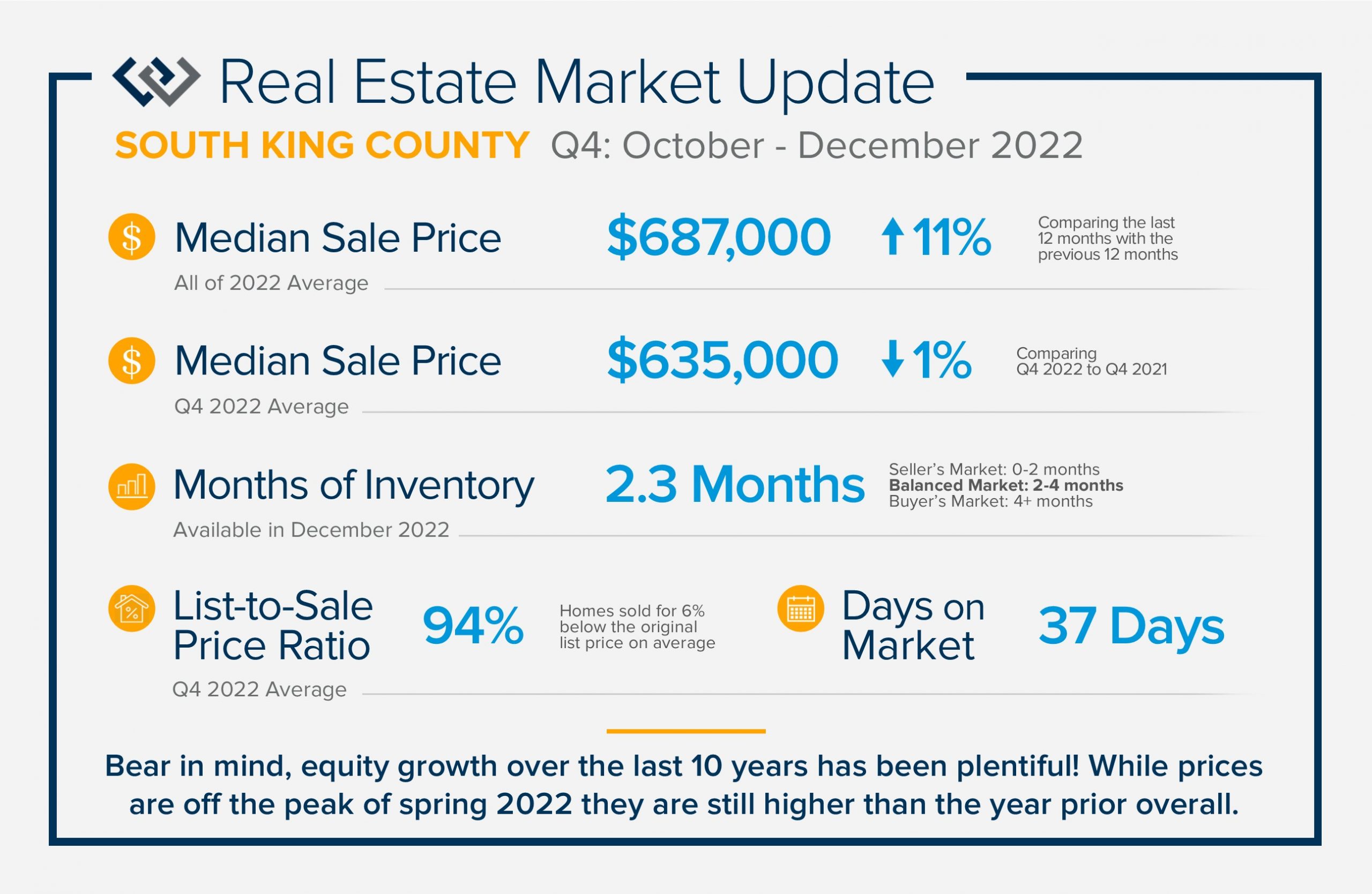

A market correction is defined by prices reverting by 10% or more. In January 2022 the median price in Snohomish County started at $700,000 then peaked at $830,000 in April, and ended the year at $689,000 (-17%). In King County, the median price started at $794,000 then peaked at $1,000,000 in May, and ended the year at $820,000 (-18%). Bear in mind that the December 2022 median price was also up 17% over the January 2021 median price in Snohomish County and up 12% in King County. This illustrates that the correction was only off the peak of spring 2022 not off of the strong equity that was built prior to that intense run-up.

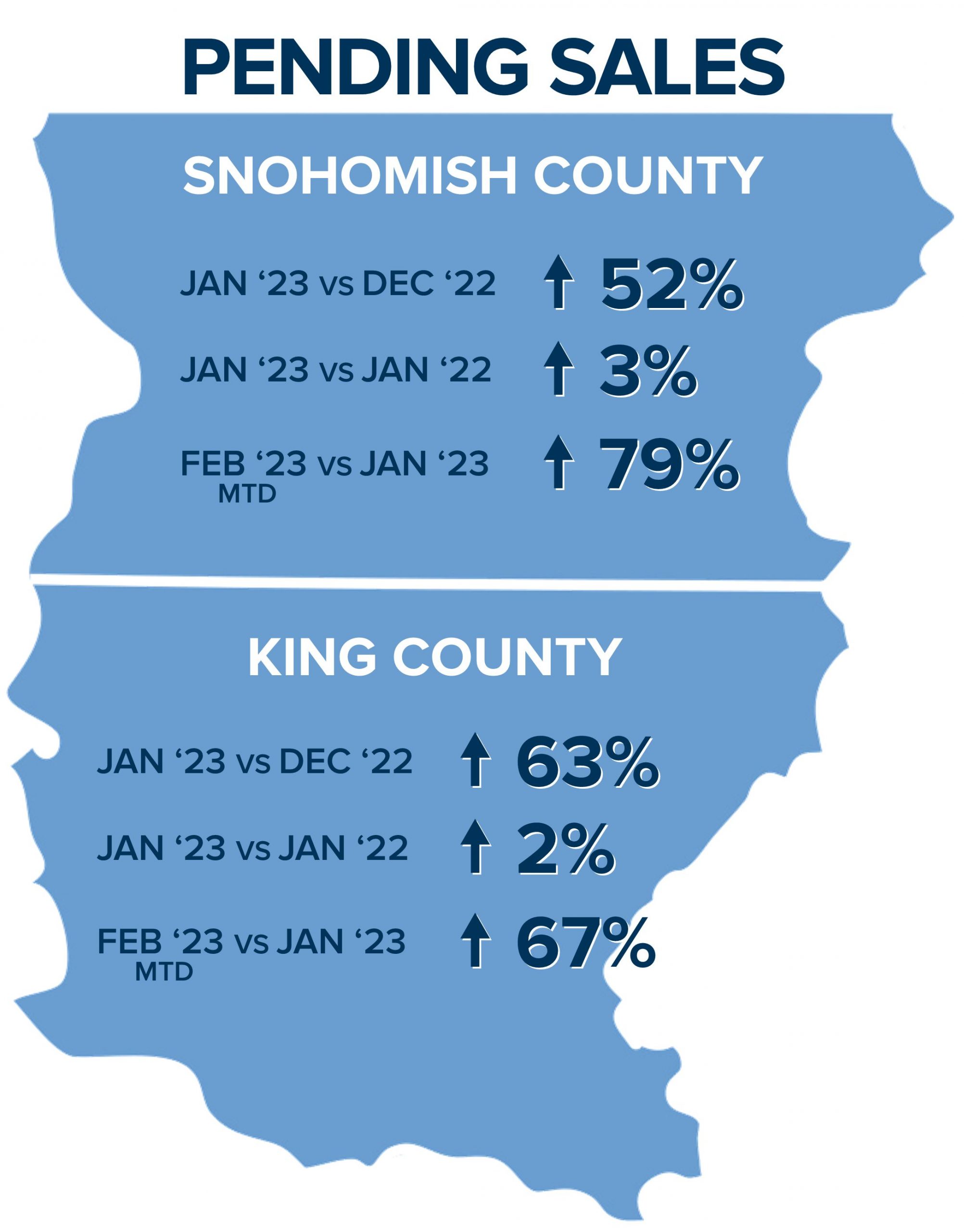

A market correction is defined by prices reverting by 10% or more. In January 2022 the median price in Snohomish County started at $700,000 then peaked at $830,000 in April, and ended the year at $689,000 (-17%). In King County, the median price started at $794,000 then peaked at $1,000,000 in May, and ended the year at $820,000 (-18%). Bear in mind that the December 2022 median price was also up 17% over the January 2021 median price in Snohomish County and up 12% in King County. This illustrates that the correction was only off the peak of spring 2022 not off of the strong equity that was built prior to that intense run-up. The well-defined price correction and interest rates lowering have brought many buyers back to the market. In fact, pending sales in Snohomish County in January 2023 were up 52% over December 2022 and were up 3% over January 2022. Even more so an indicator: pending sales are up 80% month-to-date (MTD) in February over January 2023! In King County, pending sales in January 2023 were up 63% over December 2022 and were up 2% over January 2022, and up 61% MTD over January 2023.

The well-defined price correction and interest rates lowering have brought many buyers back to the market. In fact, pending sales in Snohomish County in January 2023 were up 52% over December 2022 and were up 3% over January 2022. Even more so an indicator: pending sales are up 80% month-to-date (MTD) in February over January 2023! In King County, pending sales in January 2023 were up 63% over December 2022 and were up 2% over January 2022, and up 61% MTD over January 2023. Real estate moves are driven by life changes. It was completely understandable that many buyers took a pause as the market corrected. Now that the market is showing signs of stabilizing these life changes are pushing buyers to find the home that better fits their lifestyle. Sellers need to keep in mind that their homes need to be priced right and show up to the market well-appointed and properly prepared to get the best results.

Real estate moves are driven by life changes. It was completely understandable that many buyers took a pause as the market corrected. Now that the market is showing signs of stabilizing these life changes are pushing buyers to find the home that better fits their lifestyle. Sellers need to keep in mind that their homes need to be priced right and show up to the market well-appointed and properly prepared to get the best results.

Last week, my office had the pleasure of hosting

Last week, my office had the pleasure of hosting  The trends across the nation are consistent, but as your local expert, along with the national forecast I am committed to reporting hyper-local facts, figures, and trends to help you understand what is happening and what will happen right in our own backyard. Our local housing market was not immune to the effects of rising interest rates. Our prices peaked in the spring and as rates climbed over 6%, prices took a tumble from the spring highs inflated by cheap money. However, prices are still higher than they were in 2021 which was a recording-breaking year of price growth.

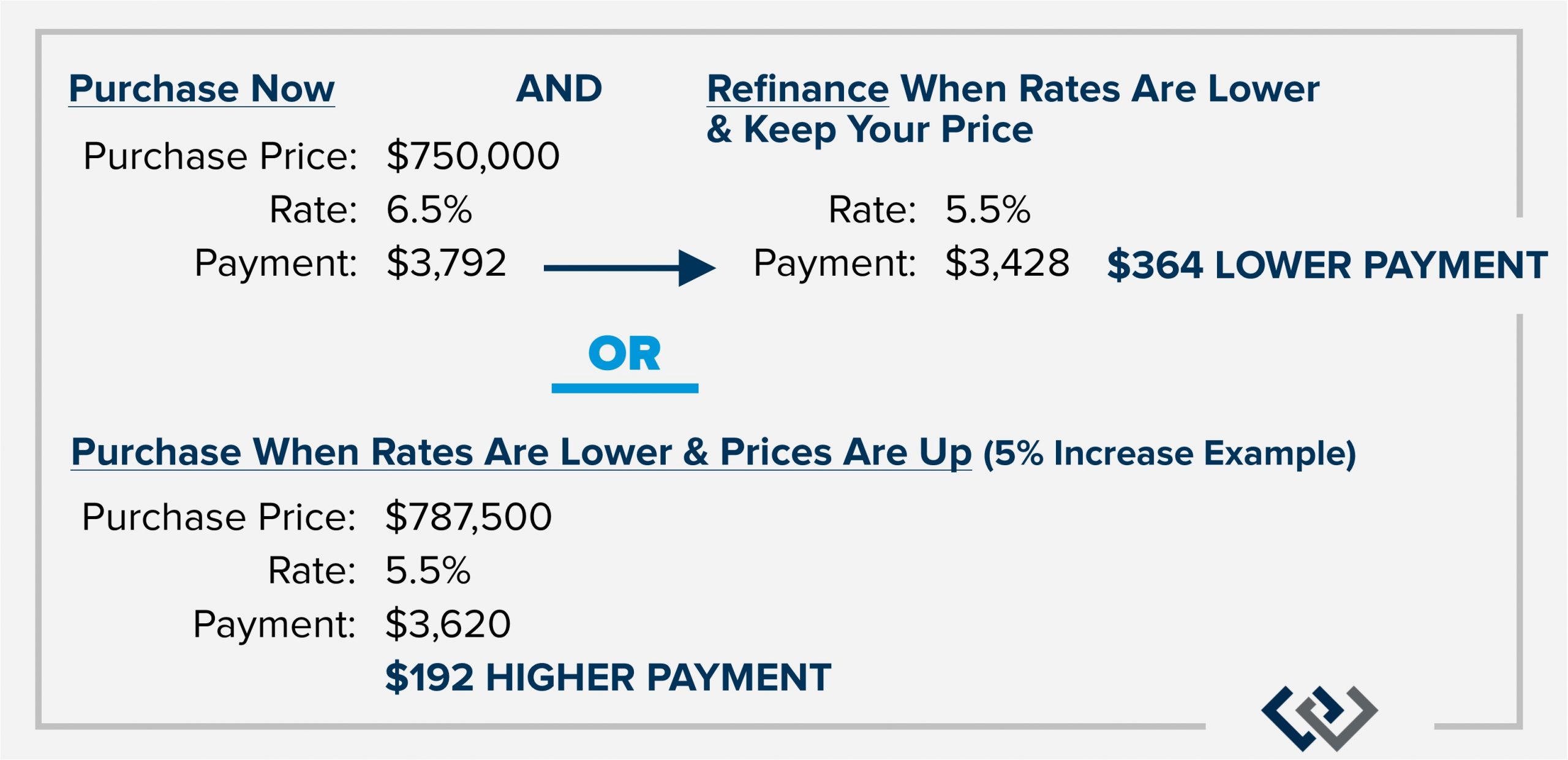

The trends across the nation are consistent, but as your local expert, along with the national forecast I am committed to reporting hyper-local facts, figures, and trends to help you understand what is happening and what will happen right in our own backyard. Our local housing market was not immune to the effects of rising interest rates. Our prices peaked in the spring and as rates climbed over 6%, prices took a tumble from the spring highs inflated by cheap money. However, prices are still higher than they were in 2021 which was a recording-breaking year of price growth. It seems that buyer demand is improving and activity is becoming more plentiful. Buyers should take note and be ready to transact if they are poised to make a move. It is a delicate dance between prices and interest rates. Buyers must understand that they can’t change their sale price once they’ve bought, but they can always refinance and change their rate. I have even heard of lenders guaranteeing a future refinance when the rate hits a certain point. Real estate is a long-term hold investment and also where you live. If where you are at doesn’t currently meet your needs, consider a move if you plan to stay there for 5+ years.

It seems that buyer demand is improving and activity is becoming more plentiful. Buyers should take note and be ready to transact if they are poised to make a move. It is a delicate dance between prices and interest rates. Buyers must understand that they can’t change their sale price once they’ve bought, but they can always refinance and change their rate. I have even heard of lenders guaranteeing a future refinance when the rate hits a certain point. Real estate is a long-term hold investment and also where you live. If where you are at doesn’t currently meet your needs, consider a move if you plan to stay there for 5+ years. Real estate is an investment and a lifestyle decision. I am committed to following experts like Matthew and others. I also study the local market trends daily. Markets change quickly and the changes are often reported far after the actual shift. I have understood these shifts due to my daily connection to the market. I take great pride in helping empower my clients to make well-informed decisions about where they live and the financial impact it has on their lives. I love what I do because it is centered in helping people with one of the biggest decisions they will make in their life. If you or someone you know are curious about how the trends relate to your goals, please reach out. I’d be honored to help educate you and help guide and strategize your next move. Here’s to a happy and healthy 2023!

Real estate is an investment and a lifestyle decision. I am committed to following experts like Matthew and others. I also study the local market trends daily. Markets change quickly and the changes are often reported far after the actual shift. I have understood these shifts due to my daily connection to the market. I take great pride in helping empower my clients to make well-informed decisions about where they live and the financial impact it has on their lives. I love what I do because it is centered in helping people with one of the biggest decisions they will make in their life. If you or someone you know are curious about how the trends relate to your goals, please reach out. I’d be honored to help educate you and help guide and strategize your next move. Here’s to a happy and healthy 2023!

2022 was a transitional year for the real estate market that started off incredibly seller-centric and ended in balance. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

2022 was a transitional year for the real estate market that started off incredibly seller-centric and ended in balance. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

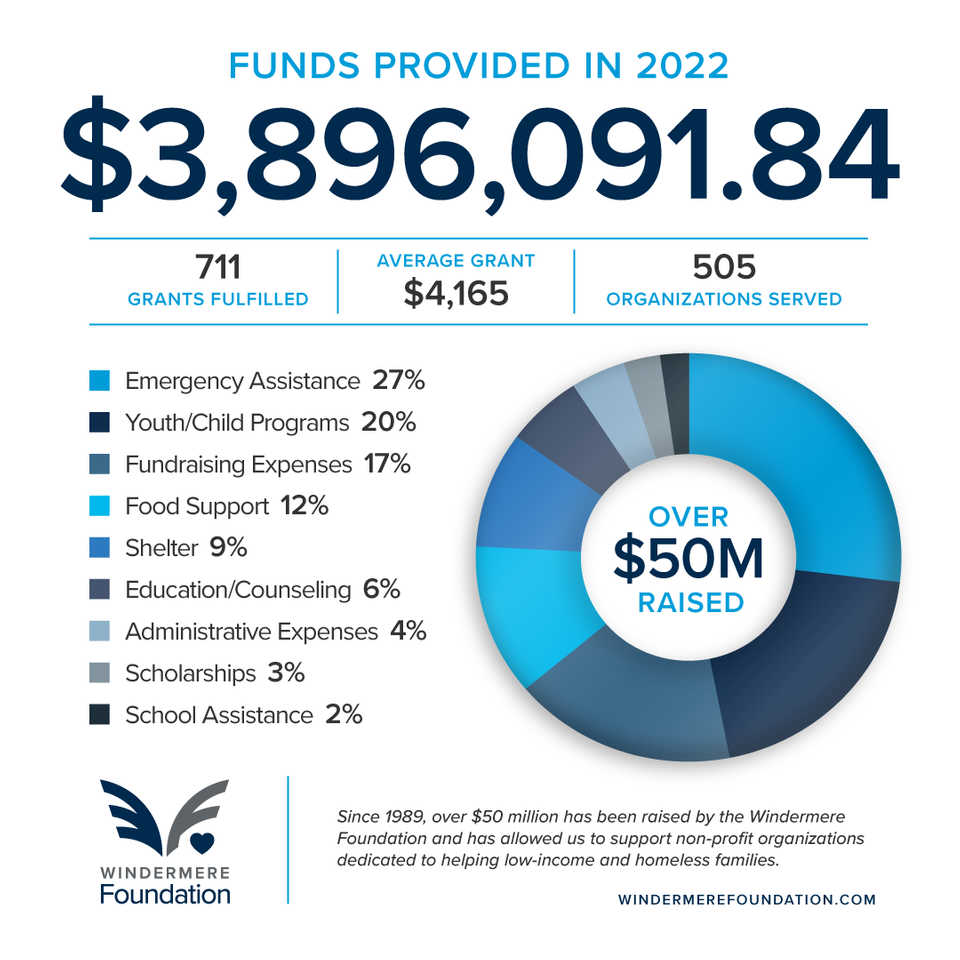

Between holiday parties, family obligations, work, and the pressure of finding the perfect gift, this time of year can come and go in a flash. At Windermere North, we never want this season to go by without coming together to lift up our community and give back in meaningful ways.

Between holiday parties, family obligations, work, and the pressure of finding the perfect gift, this time of year can come and go in a flash. At Windermere North, we never want this season to go by without coming together to lift up our community and give back in meaningful ways.